Asset Management

Municipal bonds—valuations on longer-term maturities look favorable

Chart in a Minute

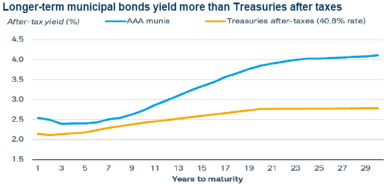

For your clients comfortable with taking on some additional interest rate risk, we think that longer-term municipal bonds are worth a closer look.

Key takeaways:

- Municipal bonds offer interest income that’s generally exempt from federal income taxes, and often state taxes, making these investments well aligned with the needs of wealthy investors.

- For clients fitting this profile and comfortable taking on some additional interest rate risk, we think that quality longer-term municipal bonds currently look attractive on a relative value basis.1

- As this chart illustrates, the after-tax spread—or yield difference—between AAA-rated municipal bonds and Treasuries is greater the further along the maturity curve an investor goes.