Asset Management

Volatility can create bond opportunities for clients

Chart in a minute

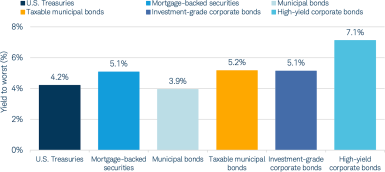

For clients with longer-term fixed income needs, the current backdrop can create opportunities to potentially capture attractive yields.

Key takeaways:

- With U.S. fiscal policies and tariff developments remaining center stage, we continue to favor a cautious approach to fixed income overall, as volatility and higher bond yields persist.

- However, with yields currently in the range of 4.0% to 5.0% on many core bonds, positive real returns should be possible over the intermediate-term horizon.

- Moreover, for clients who have longer-term fixed income needs, we believe there are pockets of opportunity to potentially capture attractive yields.