Asset Management

Is the Chinese Stock Market Rally Sustainable?

China's stock market, as measured by the Shanghai Composite Index, recently regained a level not seen in 10 years, despite a slowdown in China's economy. A change in attitudes regarding artificial intelligence (AI) innovation and a government campaign to crack down on "excessive price competition" may be the reason. But is the gain in Chinese equities sustainable?

China's economy is slowing

In their August economic data release, China's National Bureau of Statistics showed the Chinese economy slowing from the 5.3% growth in gross domestic product (GDP) for the first half of 2025. The deceleration in August was broad-based and missed the Bloomberg consensus forecasts, with retail sales gaining 3.4% year-over-year, industrial production rising 5.2%, exports increasing 4.4%, and property investment falling 12.9%.

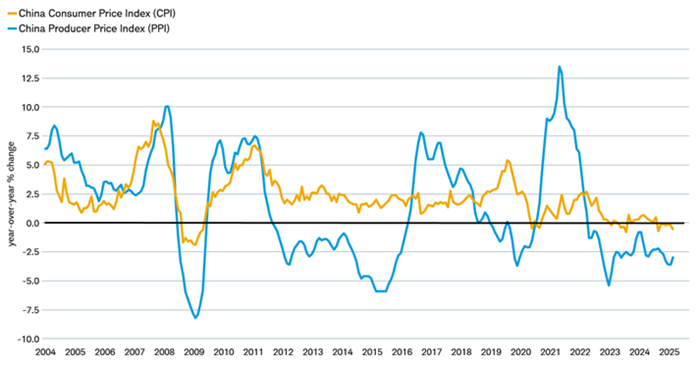

China has a structural problem of overcapacity, which is creating deflation, or falling prices. So far, manufacturers are absorbing the downward pressure on prices, with the producer price index (PPI) sitting in negative territory for nearly three years. The consumer price index (CPI) has bounced around the zero line for over two years, brought down by falling food prices. Core CPI (excluding food and energy) has posted only one month of deflation since the pandemic.

Deflation is a concern in China

Source: Charles Schwab, Macrobond, China National Bureau of Statistics (NBS) as of 9/15/2025

Fixing China's excess capacity

The lack of price inflation in China's economy has been a result of excess supply coupled with a shortage of demand. One factor contributing to excess supply is rampant competition. For example, there were over 200 car manufacturers in China in 2023, according to data provider Just Auto. Local governments often incentivize or subsidize the building of factories in new industries to capture economic and job growth. The result is downward price pressure once supply exceeds what demand can support. When faced with an economic slowdown, Beijing tends to spend on new infrastructure, further exacerbating excess supply.

On the other side of the equation, domestic demand has been depressed by low consumer confidence, which never regained momentum after the harsh "zero-COVID" lockdowns of 2022. Business confidence has also eroded over recent years due to abrupt policy changes that increased regulations and appeared to be anti-business and anti-profits.

Consumer sentiment in China is depressed

Source: Charles Schwab, Macrobond, China Economic Monitoring & Analysis Center (CEMAC) as of 9/15/2025

A change in attitude toward excess supply may be underway. On July 1, Chinese President Xi Jinping called for regulating disorderly price-cutting and excessive competition. These policies are often referred to as "anti-involution," with involution referring to a state of intense competition among companies. Industries believed to have excess competition include electric vehicles, solar panels, lithium batteries, food delivery, steel, and cement.

There's optimism some capacity could be removed from the market, which could help restore prices and margins for firms in industries with excess supply. If capacity cuts are modest and the government provides support for the labor market, the broader economic impact may be small. However, dramatic cuts across broad industries could further suppress consumer confidence and significantly hurt economic growth and jobs.

Artificial intelligence optimism

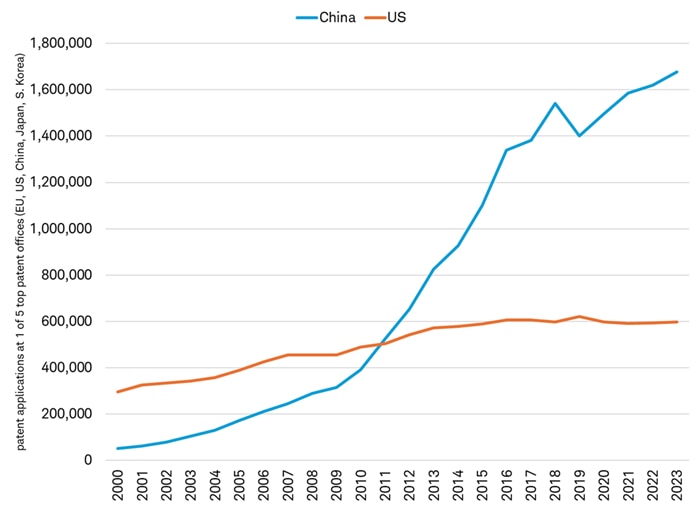

The arrival of the DeepSeek R1 artificial intelligence large language model (LLM) made headlines in January 2025 citing its low build cost, its open-source nature, and its origination in China. For years, many have viewed China as a copycat nation, unable to innovate. This idea was turned on its head after DeepSeek was unveiled. As a result, investors and competitors are increasingly acknowledging the innovation that has been present in China for many years. The U.S. National Science Foundation in its Science & Engineering Indicators 2024 report stated that China had surpassed the U.S. in STEM (science, technology, engineering, and mathematics) talent production, research publications, patents, and knowledge- and technology-intensive manufacturing. China's number of patents issued per year has exceeded the U.S. since 2011, as seen in the chart.

China is filing more patents per year than the U.S.

Source: Charles Schwab, World Intellectual Property Indicators 2024, as of 9/19/2025.

Chart shows the number of patent applications filed by the U.S. and China in one of the "IP5," the five patent offices that handle the vast majority of global patent applications. They are the U.S. Patent and Trademark Office, the European Patent Office, the China National Intellectual Property Administration, the Japan Patent Office and the Korean Intellectual Property Office.

A race to lead AI technology may be underway. In the United States, the Trump administration in July announced "America's AI Action Plan," an effort to support innovation, infrastructure, and other AI-related goals. The Chinese government is bolstering efforts to lead technology with a $8.4 billion AI investment fund to support startups, investments in education to build a base of talent, and efforts to reduce AI regulation, according to the China Ministry of Industry and Information Technology and the China Ministry of Finance. Chinese state-owned telecom companies are increasing buildouts for data centers, prompted by the government's "AI+" initiative. China's goal is to achieve an AI application penetration rate in specific industries of 70% by 2027 and 90% by 2030.

Chinese companies and local governments are adopting AI into operations, which has potential to increase productivity and lift earnings growth. Investment in AI and cloud computing by the three largest Chinese internet companies could grow by 60% in 2025, according to GaveKal Research. China was second only to the U.S. in the share of data center electricity consumption in 2024 according to the IEA.

Are Chinese stocks in a bubble?

Perceptions about Chinese stocks have gone from being potentially "uninvestable" a year ago to concerns about a possible bubble building. The Shanghai Stock Exchange Composite Index recently recaptured a level not seen in 10 years and the MSCI China Index is up nearly 40% year-to-date.

Shanghai Composite is at the highest level in 10 years

Source: Charles Schwab, FactSet, data from 8/18/2015 to 9/19/2025.

Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

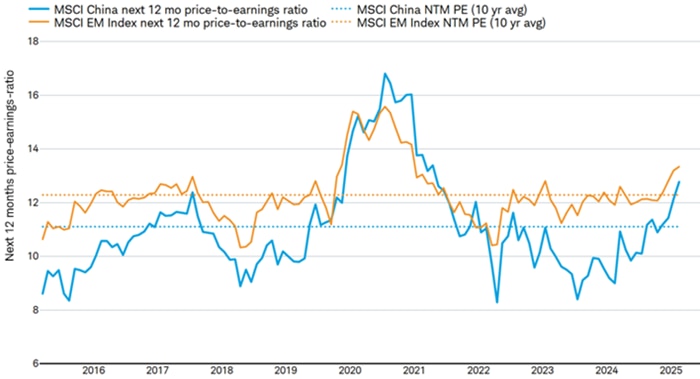

Despite the optimism surrounding the potential of anti-involution policies and AI adoption to increase profits, the reality is less certain. While profit growth for some individual companies has accelerated, the FactSet consensus earnings estimate for the MSCI China Index as a whole has continued to decline for 2025 and 2026. Therefore, the recent increase in the stock market has come from valuation expansion, not fundamental reasons. The MSCI China Index is trading at 12.8 times-next-12-months earnings, above its 10-year average of 11 times. Despite nearly 50% of the MSCI China index being in technology and internet-related companies, its valuation is at a significant discount to the 22-times-next-12-months earnings valuation for the tech-dominant S&P 500 Index. The valuation difference for tech and internet companies in China may be a combination of lower profit margins, potential for more regulation, an earlier stage of development and the potential for more competition. The valuation expansion of Chinese stocks is pulling up the MSCI Emerging Markets Index valuation, where China has a 30% weighting.

Chinese stock valuation is expanding and pulling up the emerging market index

Source: Charles Schwab, FactSet, as of 9/17/2025.

Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data. Past performance is no guarantee of future results.

Chinese stocks could continue to post strong returns if advancements in AI and anti-involution are successful, and if the government is able to stimulate consumer demand through adopting reforms that reduce precautionary savings or reduce the overhang of unsold property. U.S. dollar weakness would also likely boost returns for U.S. investors.

However, there are risks inherent to the Chinese stock market. If anti-involution is successful, there is potential for upside to margins but also slower economic growth and an increase in unemployment. China's industrial policy tends to prioritize political objectives and not profits, and its AI initiatives could result in excessive supply and price competition over time, similar to what we've seen with other industries. Chinese companies can be subject to government interference, with little advance notice. For example, Chinese regulators have started to step up warnings about instituting curbs on market speculation.

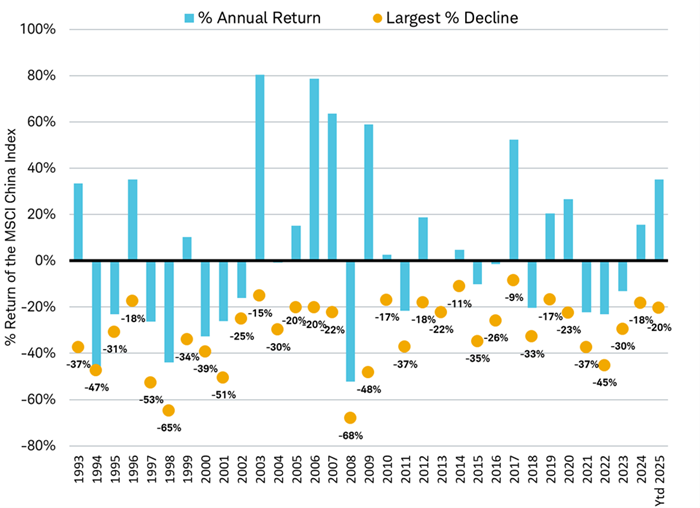

Overall, China's stock market has tended to have a bear market (as defined by a 20% decline from the latest peak) almost every year, although stocks often recover and end the year higher. The MSCI China Index fell 20% in response to U.S. tariff threats this April and given the strong gains since then, another pullback is possible. Given the balance of opportunity and risk, investors likely need a long-term time horizon and small allocations when investing in Chinese stocks.

Chinese stocks experience a bear market almost every year

Source: Charles Schwab, Bloomberg, as of 9/15/2025.

Figure for 2025 is the year-to-date return through 9/15/2025.

Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

Heather O'Leary, Senior Global Investment Research Analyst, contributed to this report.