ETFs offer a new fixed income frontier

Healthy competition for an investor's next dollar

The Federal Reserve (Fed) seems poised to cut interest rates over the coming year, yet for investors in balanced portfolios, bond yields still afford healthy competition for their next investment dollar. What’s driven yields higher over the past few years and may keep fixed income’s risk-adjusted returns competitive with equities for years to come? Sticky inflation and the return to long-term measures of ‘term-premium’ both play a role here. So, what’s a bond investor to do?

- Consider the opportunity to make tactical shifts in a bond allocation as leadership among fixed income asset classes rarely remains the same through the business cycle.

- Investment-grade corporate bonds have particular favor with us given the multi-year improvement in credit quality, with yields still above their long-term average.

- Agency mortgage-backed securities also compare well in the high-quality space, with yields nearly equal to investment-grade corporates but with arguably less credit risk given implicit and/or explicit U.S. government backing.

Looking to become an ETF Bond King?

The evolution of bond ETFs and competition among separately managed account (SMA) providers gives investors easier access to bonds at more affordable costs. These investment vehicles offer a welcome change from prior decades, where actively managed bond mutual funds received the majority of fixed income inflows. Mutual funds often had expense ratios of 0.5% or higher and touted their returns versus the Bloomberg U.S. Aggregate Bond Index, an index often viewed as the bond market equivalent of the S&P 500® index. The hundreds of billions of dollars in these funds gave rise to “celebrity” active bond managers who competed against one another. Yet looking back on that “Bond King” era, high fees often served as headwinds to performance investors actually experienced.

Today’s brighter frontier for fixed income investing

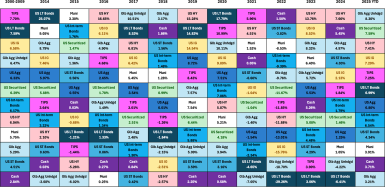

Bond ETFs can now serve as building blocks for dynamic fixed income solutions that use levers such as duration and credit quality to target desired risk-reward outcomes, all while affording tax-efficiency, transparency, and enhanced liquidity at a fraction of the cost of traditional mutual fund approaches. As we see in Exhibit 1, history suggests that customizing fixed income allocations has merit because bond category leadership rotates over time, sometimes even within the same business cycle. Rarely does one category of the bond market maintain leadership for long.

“One actionable opportunity for investors is to increase overall diversity within their fixed income allocations.”

Exhibit 1: Bond market leadership rotations through the years

Sources: Schwab Asset Management®; Bloomberg. Data as of October 31, 2025. For details on the various fixed income categories used for this chart, please see the end of this article. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes, please see: www.schwabassetmanagement.com/resources/glossary. Past performance is no guarantee of future results.

This exhibit conveys a critical point. Namely, that a number of outperforming asset classes over the years aren’t represented in the Bloomberg U.S. Aggregate Bond Index, which is approximately 40% Treasuries, 25% mortgage-backed securities, and 25% investment-grade corporate bonds, with the remainder primarily a mix of other government-related bonds. The outperforming “off-benchmark” asset classes include categories such as taxable municipal bonds and high-yield corporate bonds that may be comparatively overlooked in many core-bond strategies. Herein lies one actionable opportunity for investors, which is to increase the overall diversity within and rotation of their fixed income allocations.

A secular turn toward improving credit quality

But we believe there are even simpler, ongoing opportunities within high-quality fixed income. U.S. investment-grade corporate bonds are one such example. Borrowers in this market are represented by many of the largest and most recognizable multi-national companies that have successfully navigated through a variety of economic environments. The bonds issued by these companies generally represent both low credit risk and volatility. As a result, investment-grade corporate bonds can potentially act as ballast in investors’ portfolios during periods of volatility and economic uncertainty.

"The combination of improving fundamental quality and attractive all-in yields leads us to favor investment-grade corporate bonds, representing a second opportunity for investors.”

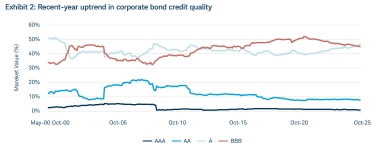

Looking beyond what we believe are the attractive yields currently offered by these securities, the better news lies squarely in the fundamentals shown in Exhibit 2. Credit quality within the U.S. investment-grade corporate bond market has moved consistently higher over the past four years, reversing a slide that had started with the recovery from the Global Financial Crisis of 2008-2009 (GFC) more than 15 years ago. Specifically, the percentage of the investment-grade market rated BBB has been declining since 2021, while single-A rated company debt has become the larger of the two by size. There are many reasons for this outcome, but the combination of improving fundamental quality and attractive all-in yields leads us to favor greater than benchmark exposure in investment-grade corporate bonds, representing a second opportunity for investors.

Sources: Schwab Asset Management; Bloomberg; Ice Index Platform. Data as of October 31, 2025. Lines represent the amount outstanding of the AAA, AA, A, and BBB subsets of the Ice BofA US Corporate Index as a percentage of that overall index. For more information on the Ice Index Platform, see: Index Platform | Home. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes, please see: www.schwabassetmanagement.com/resources/glossary. Past performance is no guarantee of future results.

The relative appeal of agency mortgage-backed securities

Where else can investors look for high-quality yields? Perhaps less well-known, but equally attractive to us today, is the agency mortgage-backed securities (MBS) market. One of the biggest features of note is that these securities are typically issued by Ginnie Mae, Fannie Mae, and Freddie Mac and backed by residential mortgages underwritten by traditional credit providers like banks. Remember, agency MBS are commonly considered quasi-U.S.-government debt from the standpoint of credit risk. Ginnie Mae MBS in particular carry an explicit guarantee of principal and interest payments by the U.S. government, while Fannie Mae and Freddie Mac are both federally chartered corporations that have long been considered to enjoy ‘implicit’ government backing.

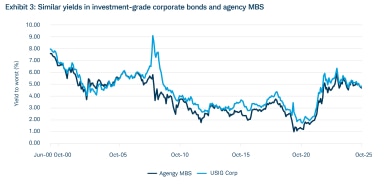

As shown in Exhibit 3, agency MBS and investment-grade corporate bond yields are essentially equivalent. With similar yields and durations today, but arguably less credit risk in agency MBS than in investment-grade corporate bonds, an incremental allocation to agency MBS beyond what exists in products indexed to the Bloomberg U.S. Aggregate Bond Index or standalone exposure outright might provide an attractive yield enhancer for a diversified allocation to fixed income.

Sources: Schwab Asset Management; Bloomberg. Data as October 31, 2025. Agency MBS are represented by the Bloomberg US MBS Index. US IG Corp, illustrating the performance of investment-grade corporate bonds, are represented by the Bloomberg U.S. Corporate Index. For more information on indexes, please see: www.schwabassetmanagement.com/resources/glossary.

Next steps to consider

ETFs have brought about revolutionary change to equity market investing by democratizing access, reducing complexity and costs, all while offering flexibility across style, geography, and market capitalizations. But further evolution after the GFC has extended the opportunity to fixed income as well. Greater price transparency, lower transaction costs, and a similar broadening of access to slices within fixed income mean that investors have choices beyond relying on Bond Kings to build winning diversified portfolios one actively selected bond at a time.

For investors who are seeking relatively defensive, high-quality sources of income or merely looking to balance existing equity exposures, we believe that investment-grade corporate bonds, agency MBS, and greater diversification within a fixed income allocation are investment opportunities worth exploring. Improving aggregate corporate credit quality to offset concerns some investors may have about a slowing economy or the security of agency MBS at attractive yields leave both of these fixed income asset classes in our favor.