Q1 Investment outlook for advisors

Trade tensions, geopolitical shifts, Fed independence concerns, and inflation uncertainty cloud the horizon. Help clients navigate these challenges with our latest insights.

Market trends and insights for advisors

Stay up-to-date on the latest market trends and investment ideas to help position clients for long-term success.

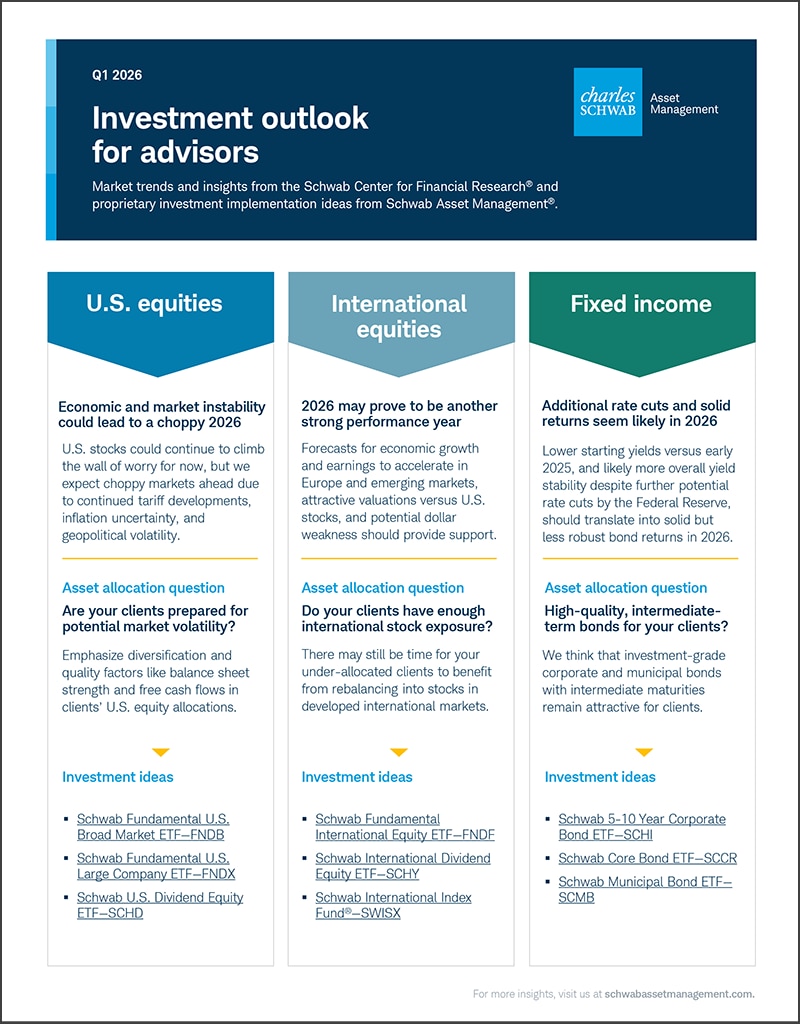

Economic and market instability could lead to a choppy 2026

U.S. stocks could continue to climb the wall of worry for now, but we expect choppy markets ahead due to continued tariff developments, inflation uncertainty, and geopolitical volatility.

2026 may prove to be another strong performance year

Forecasts for economic growth and earnings to accelerate in Europe and emerging markets, attractive valuations versus U.S. stocks, and potential dollar weakness should provide support.

Additional rate cuts and solid returns seem likely in 2026

Lower starting yields versus early 2025, and likely more overall yield stability despite further potential rate cuts by the Federal Reserve, should translate into solid but less robust bond returns in 2026.

For our Q1 Investment Outlook for Advisors, I’m Riz Hussain with two minutes on portfolio construction insights for your clients.

The start of the year is always a great time to revisit portfolio positioning and rebalancing opportunities as you plan for the year ahead. And one of the better performing asset classes in 2025 remains appealing here in early 2026, international equities. With this opportunity in mind, here are three points we think are worth highlighting as you connect with clients in the first quarter.

First, in spite of double-digit returns in 2025, international stocks are still trading at attractive valuations compared with US stocks. This is a key reason why Schwab’s 10-year return forecast for international large- and small-caps intra-emerging market stocks are all higher than the forecast for US large-caps.

Second, international equities offer diversification from US stocks. And unlike the tech-heavy S&P 500 index, financials and industrials are some of the largest sectors in developed international countries. With Germany, Europe’s biggest single economy set to roll out its largest fiscal spending package in more than 30 years, the financial and industrial sectors seem poised to benefit, and any spillover effects might stimulate activity in the rest of Europe. In addition, these exposures could potentially serve as differentiating complements to your clients’ existing domestic equity exposures.

Third, cost-efficiency, transparency, and the variety of investment opportunities have improved dramatically over the years.

Whether your clients need broad, low-cost, international market exposure, would prefer to emphasize quality companies with a consistent history of paying dividends, or are searching for non-price-weighted methodology, Schwab Asset Management offers many opportunities for your clients to invest beyond the United States.

If you have any questions about international allocations and positioning in your clients’ portfolios, please reach out to us for a complimentary portfolio consultation. Thanks for watching.

Disclosures

Investors in mutual funds and ETFs should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges, and expenses. You can obtain a prospectus by visiting schwabassetmanagement.com/prospectus. Please read it carefully before investing. Past performance is no guarantee of future results, and the opinions presented cannot be viewed as an indicator of future performance.

Investing involves risk, including loss of principal. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. International investments involve additional risks, which include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets.

Diversification strategies do not ensure a profit and do not protect against losses in declining markets.

Charles Schwab Investment Management, Inc., dba Schwab Asset Management® is a registered investment adviser and an affiliate of Charles Schwab & Co., Inc. ("Schwab").

©2026 Charles Schwab Investment Management, Inc. All rights reserved.

Timely asset allocation ideas for international equities

Want to optimize client portfolios?

Contact us for a complimentary portfolio evaluation.

Schwab Market Talk

Schwab experts address market and economic questions on advisors' minds.