Multi-asset

Multi-asset funds can provide diversification with the convenience of a single fund.

Our approach

We take a behavioral-based approach to asset allocation—an approach designed to help investors stay invested across market conditions, and that leverages our investment research and deep asset allocation expertise. To meet investor needs, we utilize a variety of underlying strategy types, including proprietary and non-proprietary as well as active and passive strategies. And our pricing approach seeks to give everyone—even the smallest business—access to a range of quality target date funds at competitive prices.

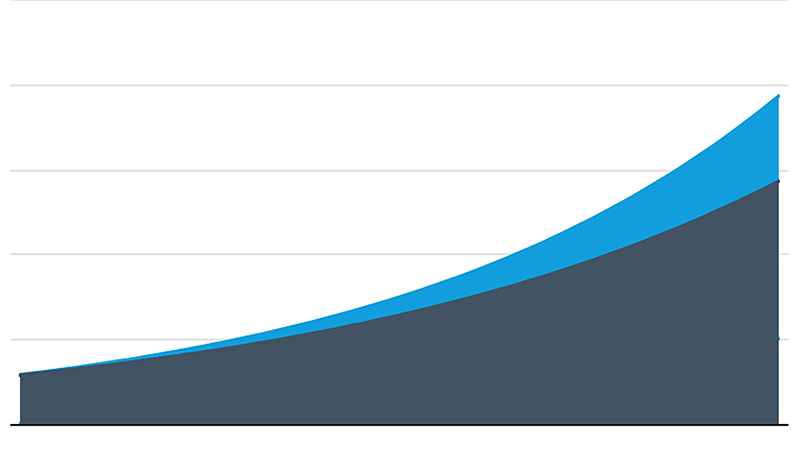

A behavioral-driven glide path design

Our target date solutions are managed to seek more growth when investors can take on more risk and greater stability when they need to rely on their investments. By taking a behavioral-driven approach to asset allocation, our carefully balanced glide path is designed to help investors reach their goals up to and through retirement.

What we offer

Since 1995, we’ve managed a lineup of multi-asset mutual funds. Now, we offer target date, target risk, and managed payout multi-asset mutual funds—a comprehensive selection of product solutions at competitive pricing, for both individuals and employer-sponsored retirement plans. And for qualified retirement plans, there are the Charles Schwab Trust Bank Collective Investment Trusts™.1

Featured multi-asset funds

See our highlighted multi-asset funds, or browse all our investment products.