Choosing Municipal Bonds: GO or Revenue?

Given all the municipal bonds to choose from, how do you decide which ones should make up the core of your portfolio? With $4.0 trillion of muni debt outstanding spread among tens of thousands of issuers, the choice may seem daunting, but we'll help you break it down.

Municipal bonds are issued by local and state governments to help fund public projects or municipal government operations, like building new schools or repairing city sewer systems. Their interest payments are usually exempt from federal income taxes and may be exempt from state income taxes if the bond issuer is located in the investor's home state. For these reasons munis are often attractive to income-oriented investors looking to reduce income tax bills.

Two broad classes of munis

Munis can generally be classified into two camps—general obligation bonds and revenue bonds. General obligation, or GO, bonds are backed by the general revenue of the issuing municipality, while revenue bonds are supported by a specific revenue source, such as income from a toll road or sewer system.

- General obligation bonds account for 28% of the investment-grade muni market and are usually backed by the taxing authority of the bond issuer. Most states and local governments issue GO bonds to help fund operations or specific projects. The dollar value of GOs issued by states compared to local governments is roughly equal, even though there are fewer states than local governments. In other words, the amount of debt issued per state is much larger than the amount of debt issued per local government.

- Revenue municipal bonds, or revenue bonds, account for nearly two-thirds of all investment-grade munis outstanding, but they tend to get less attention than their more popular counterpart, general obligation bonds. Credit quality varies more with revenue bonds compared to GO bonds, but they can be an attractive option for muni investors looking to round out a diversified portfolio or to add investments that may have higher yields, if they're willing to accept additional risks.

Composition of the municipal bond market

Source: Components of the Bloomberg Municipal Bond Index, as of 11/21/2024.

"Other" includes industry development revenue (IDR)/pollution control revenue (PCR), pre-refunded revenue bonds, housing, tobacco, and resource recovery. Numbers may not equal 100% due to rounding.

GO bonds: View on risk has changed

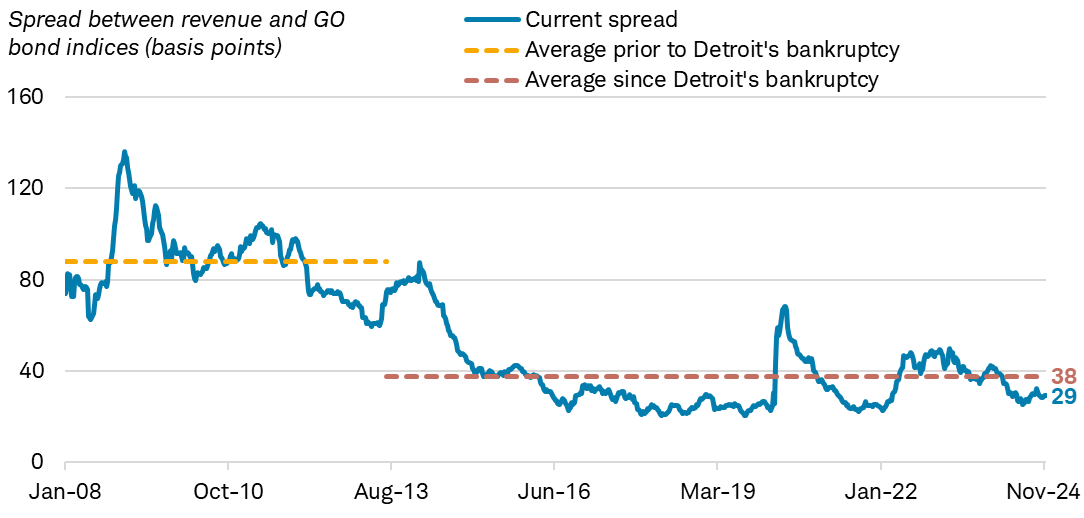

Although general obligation bonds account for only about a quarter of the muni bond market, they tend to get the most attention. Historically, GO bonds were considered the more secure of the two options, because they are backed by the full faith and credit of the municipal government. Given GO bonds' perceived security advantage, revenue bonds used to yield much more than GO bonds on average—but that has changed in recent years, as illustrated in the chart below.

The change can be partly attributed to Detroit's bankruptcy in 2013. Initially, Detroit tried to treat its GO bondholders as "unsecured" creditors, which would have gone against the market's longstanding belief of the security pledge of GOs. Detroit's bankruptcy was settled outside the court, so there was no legal opinion on its security pledge. As a result, muni market participants began to scrutinize GO bonds more closely and the spread between the two has narrowed.

Revenue bonds used to yield substantially more than GOs, but that has changed

Source: Bloomberg Municipal Bond: Revenue Bond Index and Bloomberg Municipal Bond: General Obligation Bond Index, weekly data as of 11/21/2024.

Averages are from 1/4/2008 to 7/12/2013 and 7/19/2013 to 11/21/2024. Averages shown are in basis points; a basis point is one-hundredth of a percentage point, or 0.01%. Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly.

There are many types of revenue bonds

A mistake some investors make is to lump all revenue bonds in the same category. Given the size and diversity of the revenue bond market, astute investors can benefit from identifying the right type of revenue bonds for their needs and focusing a portion of their municipal bond portfolio there.

The most common types of revenue bonds are:

- Water and sewer/public power electric utilities bonds: Water and sewer revenue bonds are issued to finance the construction and improvement of sanitation or water utility facilities. Revenues to meet debt service are derived from various rates and fees, which most often are based on usage and connections. Public power electric utilities acquire or generate electric power and provide it to their constituents.

- Special tax revenue bonds: A special tax revenue bond is a bond that is repaid by levying a tax on a particular activity or asset. For example, a special tax may be levied on the sale of alcohol or tobacco to help fund a new cancer research facility.

- Transportation revenue bonds: Transportation revenue bonds are issued to finance local public transportation projects, such as buses, subway systems, toll roads and airport systems. The bonds are repaid through the revenue earned by the transportation system.

- Education revenue bonds: Education revenue bonds are issued to finance the construction or improvement of higher-education facilities, like public and private colleges, or help with ongoing operations. Revenue is derived from students' tuition payments or from the institution itself

- Hospital and health care revenue bonds: Hospital bonds are issued to finance the construction or expansion of hospitals or health care facilities. They generate a large share of their revenues through reimbursements for services from either commercial insurers, commercially insured patients, patients insured through public entities such as Medicare and Medicaid, or self-pay from patients lacking insurance.

- Lease revenue bonds: Lease revenue bonds are a unique structure in the muni market. Instead of issuing long-term debt, like general obligation bonds, to finance improvements on a public facility, the municipality may enter into an arrangement that uses lease revenue bonds. Often a trust, not the municipality, issues bonds and generates revenues to pay the bonds back by leasing the facility to the municipality. The municipality will generally appropriate money during each budget session to meet the lease payment.

GO bonds tend to be higher-rated than revenue bonds, on average

Given the more diverse makeup of revenue bonds, they also tend to have more diverse credit ratings. Credit ratings for revenue bonds vary more than for general obligation bonds, as illustrated in the chart below. For example, 62% of general government, which include GOs, are Aa3 rated or higher, whereas only 41% of competitive enterprises,1 which include revenue bonds, are Aa3 or above.2 On the other end of the spectrum, less than 6% of general governments are in the Baa category but close to 18% of competitive enterprises are in that same rating category.

General governments and municipal utilities tend to be highly rated

Source: Moody's Investors Service, as of 10/24/2024.

It's rare for municipal bonds to default and even rarer for general governments, which include GO bonds, to default. The recent rise in defaults by general governments is the result of defaults by Puerto Rico and Detroit. Although state and local governments face headwinds, such as a potential slowdown in the economy, we think defaults among munis will continue to be rare.

GO bonds historically have rarely defaulted

Source: Moody's Investors Service, as of 10/24/2024.

Revenue bonds may offer higher yields

Although GO bonds tend to have higher credit ratings and default less, we don't think that revenue bonds should be overlooked as they can offer higher yields but come with higher risks. For example, the average transportation bond yields close to 3.78% compared to 3.23% for the average state general obligation bond. The difference in yields may be because the average transportation bond has a lower credit rating and longer duration than the average state GO. Bonds with longer durations are more sensitive to changes in interest rates.

Characteristics of municipal bond sectors

Source: Components of the Bloomberg Municipal Bond Index, as of 11/21/2024.

Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly.

What investors can consider now

Given the potential for a slowdown in the U.S. economy and stress on some municipal governments, we think it's especially important today to know what is backing your municipal bond and how to combine different muni bond types to build a well-diversified portfolio.

General obligation bonds, in combination with other essential service revenue bonds, can serve as the core of a muni portfolio. First, focus on higher rated issuers—those rated AA-/Aa3 or above.

If you're a Schwab client investing in municipal bonds through mutual funds or exchange-traded funds (ETFs), you can find the ratings distribution and breakdown of GO and revenue bonds on the "Portfolio" tab on Schwab.com. For help in selecting municipal bond investments that are right for your personal situation, consider reaching out to a Schwab Fixed Income Specialist.

1 Moody’s defines “Competitive Enterprises” as charter schools, higher education, private colleges & universities, hospitals & health service providers, hotel, housing, not-for-profit, and private K-12.

2 The Moody's investment grade rating scale is Aaa, Aa, A, and Baa, and the sub-investment grade scale is Ba, B, Caa, Ca, and C. Standard and Poor's investment grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C. Ratings from AA to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. Fitch's investment-grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C.