How to Build a Bond Portfolio

Despite some wide swings over the last few years, most bond yields still remain elevated. Investors wondering if they've missed the opportunity to earn attractive yields should keep in mind that yields are still generally higher than they were for the 10-year period following the global financial crisis.

There may be some confusion regarding how to actually invest, given how large and complex the bond market is. Below we'll address four key points about bond investing, ranging from "how" to invest to "why now?"

1. Bonds for income and capital preservation

These are two of the key reasons to own high-quality bond investments. Most bonds make semiannual interest payments that are known in advance based on a percent of the bond's par value. A missed interest payment generally triggers a default for the issuer, whereas stock dividend payments are discretionary and can be raised, lowered, or eliminated based on the outlook for the company. Defaults for highly rated investments tend to be rare, however; default risk is highest for investments with sub-investment-grade, or "junk," ratings.

Bonds also have fixed par values and maturity dates, so barring a default, investors know in advance what they'll receive and when.

Bond prices can still rise and fall in the secondary markets, which might catch investors off guard because bonds are often considered "safe" investments. Bonds have interest rate risk, so their prices can rise and fall with the changing interest rate environment, as the chart below illustrates.

Shown below is the price of a Treasury note that matured in May 2025. It was issued in May 2015 at its $1,000 par value—meaning it was a 10-year note when issued—and matured at its $1,000 par value. As you can see, it was a bumpy ride along the way, illustrating that even high-quality investments like U.S. Treasuries can experience ups and downs. Yet the Treasury note matured at its par value in May 2025, meaning the principal was preserved, while still paying 2.125% annually to bondholders. Holding bonds to maturity can help investors "look through" any potential price changes, as those price increases and decreases are ultimately unrealized. Keep in mind that this illustration is for one individual bond. Bond mutual funds and ETFs generally don't have set maturity dates or par values, so there are additional considerations for investors when deciding what approach is most appropriate.

Even high-quality bonds can see large price swings, but barring default should mature at their par value

Source: Bloomberg, using daily data as of 5/15/2025.

U.S. Treasury Note, 2.125% coupon rate, 5/15/2025 maturity date. For illustrative purposes only. Past performance is no guarantee of future results.

2. Start with core bonds and add lower-rated investments, depending on your risk tolerance

The bond market is large and complex, with different types of bonds with varying degrees of risk. It can be difficult to know where to even start.

We suggest most investors first focus on "core" bonds, or high-quality bonds, like U.S. Treasuries, certificates of deposit, agency mortgage-backed securities, investment-grade corporate and municipal bonds, as well as Treasury Inflation-Protected Securities. These generally have low to moderate credit risk, depending on the investment, and tend to offer more diversification benefits when combined with stocks in a portfolio compared to bond investments with more risk. Think of core bonds as the "ballast" to your portfolio. We suggest they make up the bulk of your fixed income holdings.

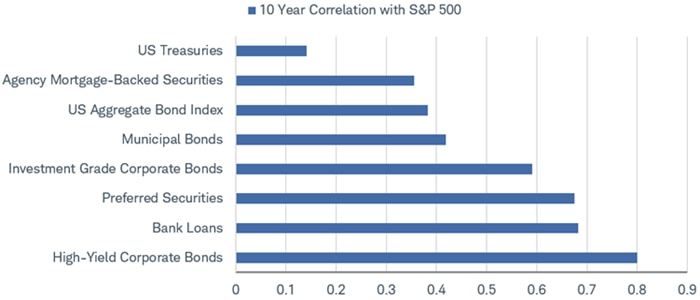

Over the past 10 years, U.S. Treasuries have had a very low correlation with the S&P 500® index, while other high-quality investments like agency mortgage-backed securities, municipal bonds, and the Bloomberg US Aggregate Bond Index have had slightly higher but still relatively low correlations. Riskier investments at the bottom of the chart below have high correlations with U.S. stocks, so if the stock market is falling, it's likely that these investments are as well.

Fixed income investments: Correlations with the S&P 500 Index

Source: Schwab Center for Financial Research with data from Bloomberg.

Indexes representing the investment types are: US Treasuries = Bloomberg U.S. Treasury Index; Agency Mortgage-Backed Securities = Bloomberg MBS Index; US Aggregate Bond Index = Bloomberg U.S. Aggregate Bond Index; Municipal Bonds = U.S. Municipal Bond Index; Investment Grade Corporate Bonds = Bloomberg U.S. Corporate Bond Index; Preferred Securities = ICE BofA Fixed Rate Preferred Securities Index; Bank Loans = Morningstar LSTA Leveraged Loan 100 Index; High-Yield Corporate Bonds = Bloomberg U.S. Corporate High-Yield Bond Index.

Correlation is a statistical measure of how two investments have historically moved in relation to each other, and ranges from -1 to +1. A correlation of 1 indicates a perfect positive correlation, while a correlation of -1 indicates a perfect negative correlation. A correlation of zero means the assets are not correlated. Correlations shown represent an equal-weighted average of the correlations of each asset class with the S&P 500 during the 10-year period between June 2015 through June 2025. Diversification strategies do not ensure a profit and do not protect against losses in declining markets. Past performance is no guarantee of future results.

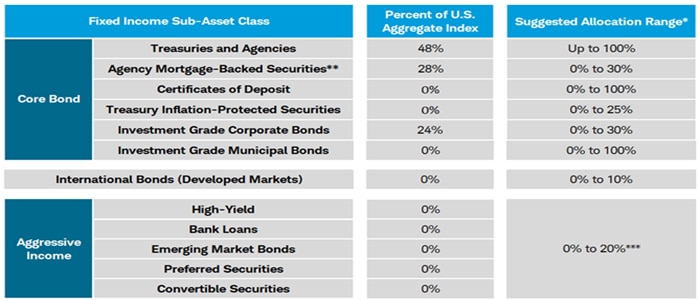

After building a base of core holdings, investors may consider adding "aggressive income" investments like those highlighted in the table below. These investments come with greater risks—like the risk of default—and any allocation should be in line with an investor's risk tolerance. These investments should always be considered as a complement to core bond holdings, not a substitute.

A framework for bond investing

Source: Schwab Center for Financial Research.

* Suggested allocation range as a percent of the overall portfolio.

** Agency mortgage-backed securities includes Ginnie Mae, Fannie Mae, and Freddie Mac mortgage-backed securities.

*** We suggest the total of all aggressive income investments constitute no more than 20% of an investor’s overall portfolio unless the investor's objective is for high income with a high tolerance for risk.

For illustrative purposes only. The information here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The type of securities and investment strategies mentioned may not be suitable for everyone. Each investor needs to review a security transaction for his or her own particular situation.

3. Higher yields come with higher risks

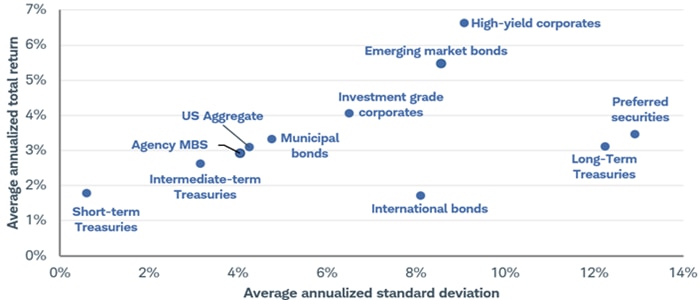

The higher yields that aggressive income investments offer may be tempting, but they come with more volatility and larger potential drawdowns. The chart below compares the average annualized total returns with the average annualized standard deviation (a measure of risk) between many fixed income asset classes. The Y axis represents the annualized total returns—the higher the dot, the higher the average return. But it also shows that higher returns tend to come with more risk, as the X axis illustrates. A higher standard deviation means more volatility, so investors reaching for higher-yielding investments need to be ready to ride out the ups and downs.

Riskier investments like high-yield bonds and preferred securities also tend to have higher correlations with stocks, so they don't provide many diversification benefits to an overall investment portfolio. A high correlation means that their total returns tend to move in the same direction as stock total returns. That can be a good thing when stock prices are rising, but when stocks are falling they tend to fall as well.

Higher yields come with higher risks

Source: Schwab Center for Financial Research with data from Bloomberg.

Average annualized total returns and standard deviations are for the 20-year period from June 2005 through June 2025. Standard deviation is a measure of how much an asset's return varies from its average return over time. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Indexes represented are: High-yield corporates = Bloomberg U.S. Corporate High-Yield Bond Index; Preferred securities = ICE BofA Fixed Rate Preferred Securities Index; Investment-grade corporates = Bloomberg U.S. Corporate Bond Index; Municipal bonds = Bloomberg Municipal Bond Index; US Aggregate = Bloomberg U.S. Aggregate Bond Index; Short-term Treasuries = Bloomberg U.S. Treasury Short-term Index; Intermediate-term Treasuries = Bloomberg Treasury Intermediate-term Index; Long-term Treasuries = Bloomberg U.S. Treasury Long-term Index; Agency MBS = Bloomberg U.S. MBS Index; International bonds = Bloomberg Global Aggregate ex-USD Bond Index; and Emerging markets = Bloomberg Emerging Market USD Aggregate Index, Past performance is no guarantee of future results.

High-yield corporate bonds have low credit ratings and have higher default rates than those with investment-grade ratings, so when the economic outlook deteriorates, they tend to underperform. Corporate profits tend to suffer in a slowing economic environment, meaning it could be more difficult for low-rated corporations to remain current on their interest payments or even repay a maturing bond. Long-term investors willing to ride out the ups and downs can still hold high-yield bonds (or bond funds) in moderation given their relatively high yields. However, there may be better opportunities down the road should economic growth slow—or worse, a recession hits—pulling spreads to a more attractive level.

4. No one rings a bell at the top

When yields hit their peak, they rarely stay there for a sustained period of time. The recent fluctuations in Treasury yields suggests that trend continues.

Over the last 30 years, the 10-year Treasury yield tended to fall once it hit its peak, and that trend appears to be intact today. After touching 5% in October 2023, the 10-year Treasury yield has whipsawed since then, falling to 3.6% in September 2024, then back to 4.8% in January 2025, and then back to near 4.4% in late July. We believe that 5% yield was the cyclical peak.

The 10-year Treasury yield rarely holds steady at its peak

Source: Bloomberg, using weekly data as of 7/11/2025.

US Generic Govt 10Yr (USGG10YR Index). Past performance is no guarantee of future results.

Although the 10-year Treasury yield is below its recent peak, it's still at the high end of the post-financial crisis trading range. Aside from the last three years, the 10-year Treasury yield hadn't touched 3.7% since 2011.

Waiting for yields to rise back to their recent highs is also an attempt to time the market, which is something we rarely suggest for long-term investors. Just as we wouldn't suggest a stock investor wait for the market to bottom—potentially missing out on gains if the bottom already happened—we don't suggest investors wait for the perfect time to invest. Yields for high-quality investments are still their highest levels in years, so we suggest investors take advantage by considering bonds today. Bond ladders can still make sense for long-term investors, but keep in mind there can still be some volatility with individual bond prices in the secondary market.

What investors can consider now

We still see opportunities for investors. We prefer high-quality fixed income investments, like the "core" bond segments mentioned above. We're cautious on the riskier parts of the market over the short run mainly due to the low relative yields they offer. While long-term investors who can ride out potential ups and downs can consider the riskier parts of the market, like high-yield bonds, in moderation, there may be better entry points down the road.

There are number of ways to invest in bonds: individual bonds, mutual funds, exchange-traded funds (ETFs), or separately managed accounts. There are benefits, and drawbacks, of each approach, and it ultimately comes down to investor preferences.

Schwab clients may search for individual bonds that meet their investment objectives and investing time horizon. For investors considering bond funds, the Mutual Fund Select List or ETF Select List are two good places to consider. Separately managed accounts offer professional management, but investors actually own each individual bond.