Discovery

Explore how Fundamental Index® works, why this approach was developed, and how it compares with a market cap-weighted approach.

Big picture: A different way to diversify portfolios

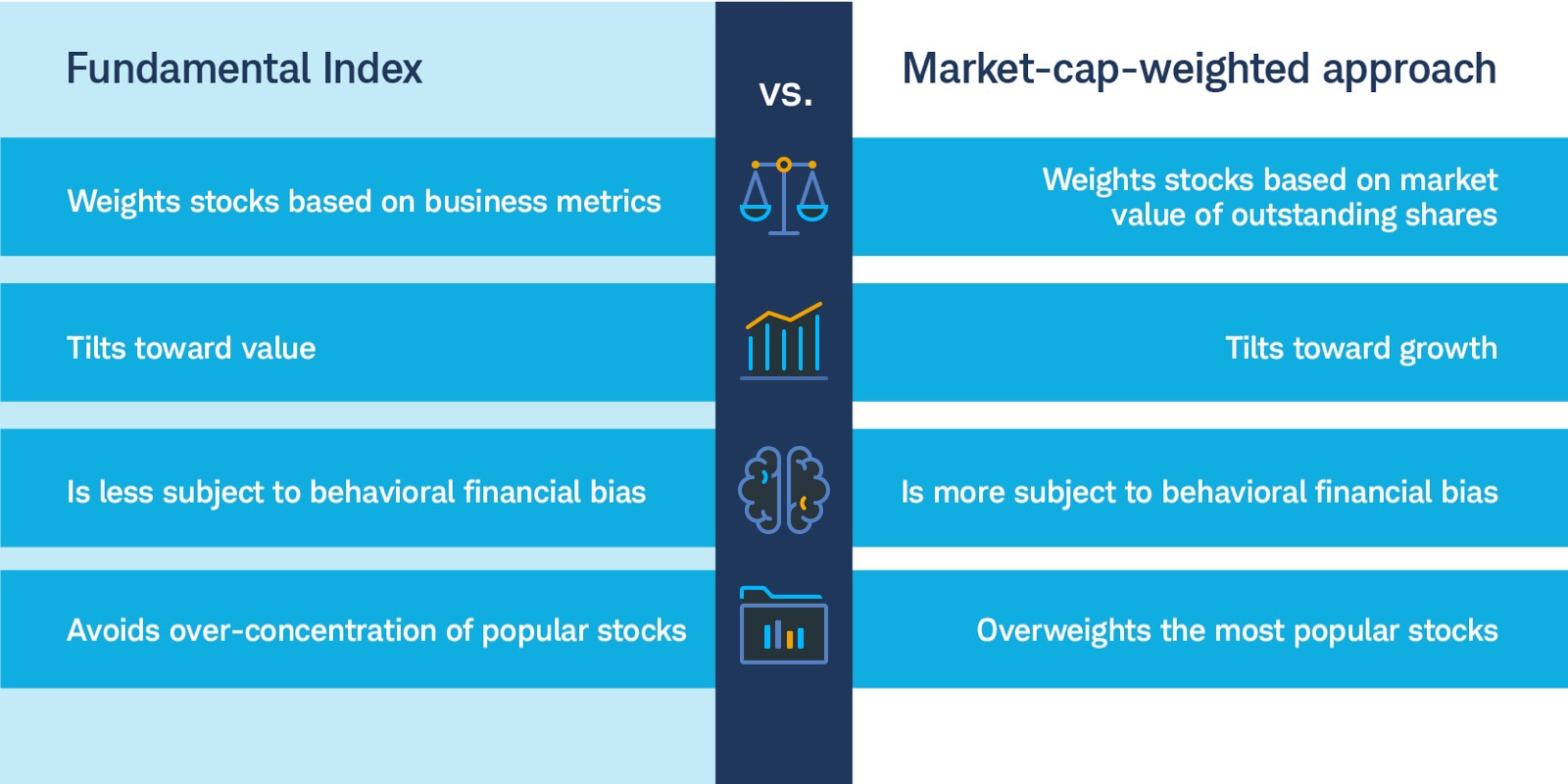

Fundamental Index is a strategy built on principles of contrarian investing in that it selects and weights stocks based on objective financial measures of company size rather than stock price. Fundamental Index can serve as a complement to traditional, market-capitalization index strategies.

What is Fundamental Index investing?

A strategic beta strategy that weights stocks based on economic size

Fundamental Index is a strategic beta strategy that weights stocks based on each company's publicly recorded metrics, making it a simple, transparent methodology.

Born out of economic crisis

When the internet first boomed in the 1990s, stock prices for tech companies soared. The market overweighted these companies accordingly until the crash in 2000. This event brought with it a focus on excessive speculation on a price-weighted approach.

Following the financial crisis, Research Affiliates was founded to look for alternative indexing strategies. The first fund following a Fundamental Index strategy launched in 2005.1

Timeline source: Research Affiliates.

Based on contrarian investing principles

Fundamental Index is built on the principles of contrarian investing. The Fundamental Index approach weights securities based on fundamental measures of company size, breaking the link between price (market capitalization), and weight.

Built to capture value at different points in the market cycle

This investment approach has had a historical bias toward securities that are inexpensive relative to their earnings, which may make it well suited to value-driven market conditions, especially early stages of the business cycle.

Chart source: Research Affiliates. For illustrative purposes only. Past performance does not guarantee future results.

How does this approach work?

Fundamental Index uses metrics of a company's economic value to weight stocks

The RAFI Fundamental High Liquidity Index2 approach, for example, combines a five-year period of adjusted sales, retained operating cash flow, and dividends plus buybacks to determine the weight of the stocks for each company. These metrics are rebalanced quarterly.

Stock weights fluctuate with changes in business metrics

Fundamental Index weights stocks based on their economic size and performance. Because of this approach, Fundamental Index behaves more objectively. Stock weights fluctuate with changes in business metrics while being less affected by public sentiment.

This approach preserves some benefits of market capitalization

The Fundamental Index approach captures some of the same benefits investors experience with market capitalization, such as liquidity, diversification opportunities, and broad market participation.