Wasmer Schroeder™ Strategies

With Wasmer Schroeder Strategies, you don’t have to build your clients’ fixed income portfolio on your own. We work with you to match our professionally managed solutions to their portfolio objectives, so you can stay focused on the big picture.

Dedicated service

Our commitment to providing fixed income solutions for your clients includes assistance with asset transitions, prompt and reliable communication, in-depth market analysis, and more.

Fixed income expertise

We harness decades of expertise to build fixed income strategies that aim to balance risks and returns to help your clients meet their portfolio objectives.

Managed by Schwab Asset Management®

At Schwab Asset Management, we seek to leverage our experience, data, and insights to help provide value to investors and the advisors who serve them.

What we offer

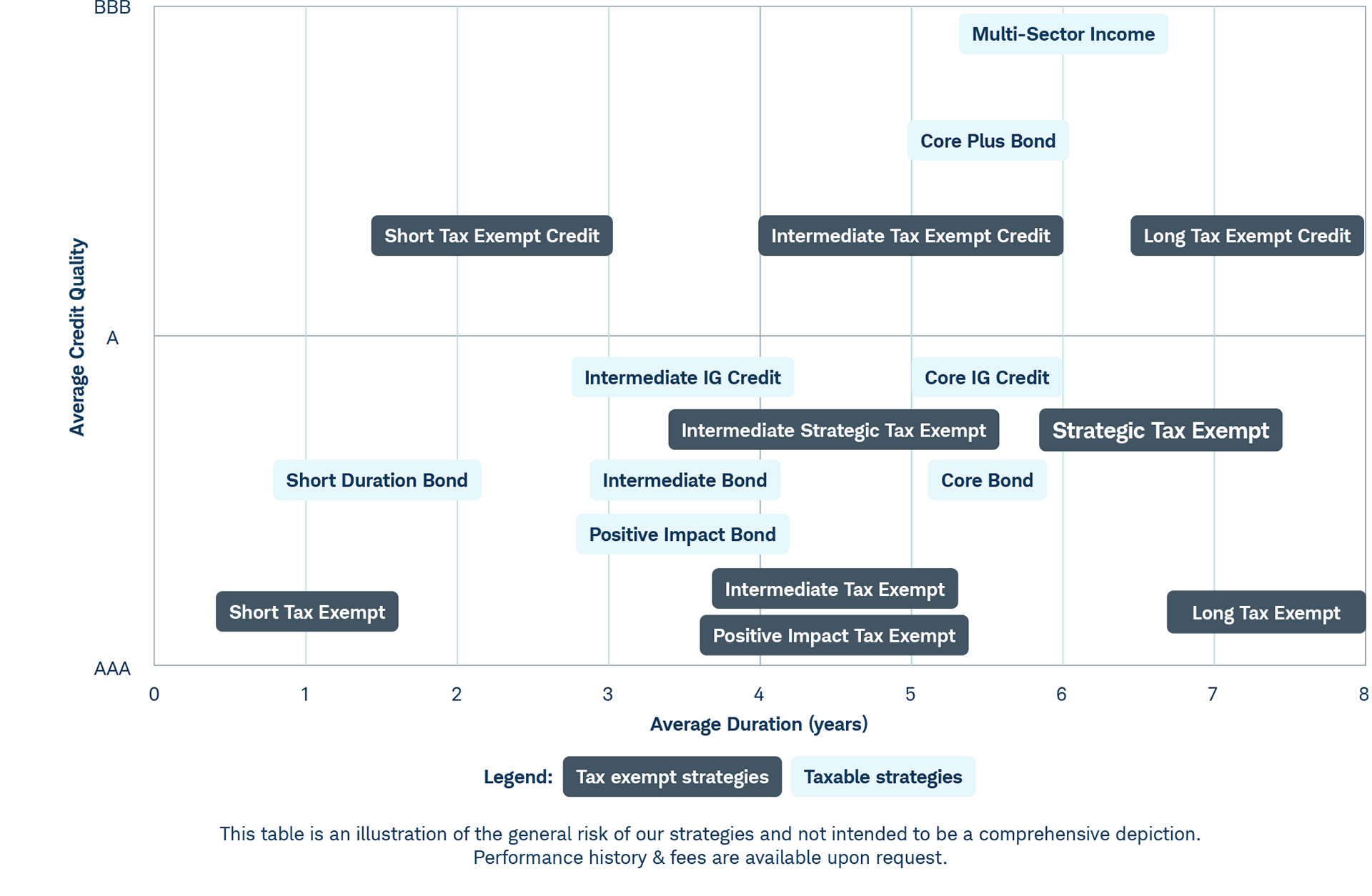

We provide a broad host of portfolio strategies across the duration, credit, and tax-efficiency spectrum.

- Creating specific liquidity, credit quality and maturity mandates can provide clients with portfolios designed for their needs

- Wide range of portfolio strategies to meet specific client objectives

- Specific investment policy statements

- Various strategy options can utilize credit opportunities

Tax exempt strategies overview

Tax Exempt Strategies Overview

|

Credit Quality |

Short Duration |

Intermediate Duration |

Long Duration |

|---|---|---|---|

|

High Quality |

Short Tax Exempt |

Intermediate Tax Exempt Positive Impact Tax Exempt |

Long Tax Exempt |

|

Investment Grade |

Intermediate Strategic Tax Exempt |

Strategic Tax Exempt |

|

|

Credit |

Short Tax Exempt Credit |

Intermediate Tax Exempt Credit |

Long Tax Exempt Credit |

Taxable strategies overview

Taxable Strategies Overview

|

Credit Quality |

Short Duration |

Intermediate Duration |

Longer Duration |

|---|---|---|---|

|

High Quality |

Short Duration Bond |

Intermediate Taxable Positive Impact Bond |

Core Bond |

|

Investment Grade |

Intermediate IG Credit |

Core IG Credit |

|

|

Limited Below Investment Grade/Multi-asset |

Core Plus Bond Multi-Sector Income |

Strategies comparison

Bond ladder strategies

Tax-exempt

- 1-5 Yr Municipal Bond Ladder

- 1-12 Yr Municipal Bond Ladder

- 3-12 Yr Municipal Bond Ladder

- 5-15 Yr Municipal Bond Ladder

Credit Quality: High quality bonds with a majority of holdings typically rated ‘AA’ or higher

Sector Allocation: Diversified mix of essential service revenue bonds and state & local general obligation debt

Taxable

- 1-5 Yr Taxable Bond Ladder

- 1-10 Yr Taxable Bond Ladder

- 3-7 Yr Taxable Bond Ladder

- 5-10 Yr Taxable Bond Ladder

Credit Quality: Investment grade portfolio with ‘BBB’ exposure limited to 60%

Sector Allocation: Primarily corporate bonds and taxable municipal bonds