JENNA DAGENHART: Here with us today is Jake Gilliam, Managing Director and Head of Portfolio Construction Solutions supporting Schwab Asset Management.

Well, Jake, we’ve seen model portfolios really gain traction over the past few years, as advisors look for ways to scale their business. Given this shift in how advisors approach portfolio management, what is your team hearing from advisors as it relates to their greatest needs for help with asset allocation and portfolio services?

JAKE GILLIAM: Well, thanks, Jenna. It’s great to be here, and I appreciate the topic.

First, simplification is a big need for advisors. Helping to simplify their practice, their model portfolios, dealing with legacy positions, maybe small weights that they’ve accumulated in client accounts over the years, it brings with a large burden of oversight, rebalancing, and a lot of things that take advisors away from the focus of their ultimate objective, which is getting clients to that financial success and the outcome that they’re seeking. So helping with portfolio construction, removing that burden, allowing them to focus on client success.

Second is around fees. Advisors looking to scale may have embedded exposures that have much higher costs than what’s prevailing in the market today. They bought a legacy position, as I referenced, maybe five, 10 years ago. The landscape today for price and what you can buy a strategy at is vastly different than it was five to 10 years ago, with market prices coming down for really all strategies across the board.

Last but not least, advisors are looking for objective insights. They find a lot of value meeting with a team. The Schwab Asset Management team that’s objective to them can review their allocations, investments, decisions from that outside lens, and help to identify exposures that may not have been intended or risks that, frankly, could have been outside of their own line of sight as they did their work with their own team, within their own firm, for their own clients.

JENNA: Could you tell us how Schwab Asset Management approaches asset allocation and portfolio construction, and how it might differ from other approaches in the industry?

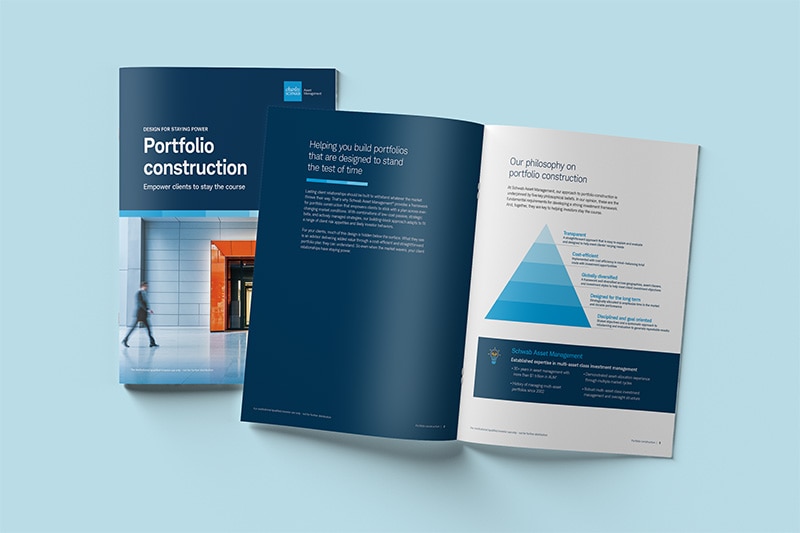

JAKE: You got it, Jenna. So we take a building block approach that utilizes passive, active, and fundamental index strategies. We call it the ABC Asset Allocation Framework, going back to the building blocks, little ABC building blocks, as it’s designed to be simple, straightforward, transparent, so that it’s easy for advisors and investors, both, to understand. It provides flexibility with purely market cap-weighted portfolios, a combination of cap-weighted and fundamental index strategies, or cap-weighted, fundamental, and active management all layered in together. That provides advisors with various cost-efficient options to meet their clients’ desired exposures and overall risk objectives.

The approach is unique in that we explicitly apply behavioral finance in the allocations. We’re very mindful of the trade-off between not just cost and tracking error, but also the investors’ needs and wants, and their emotions, and their cognitive decision-making that might be in conflict with their objectives. That’s baked into our asset allocation philosophy. It’s very important to us, and that helps us with our unique recipe, we call it, of combining asset classes of different types, like cap-weighted and fundamental, to build diversified portfolios with the end client success in mind.

JENNA: Can you describe your three different portfolio options in more detail, and why an advisor might choose one over the other?

JAKE: Will do. Our A portfolios are purely cap-weighted, so market cap exposures. They provide diversified exposure at a very low cost. They might be appropriate for clients who are sensitive to closely matching the market, and keeping costs and that friction between their performance and what they’re paying for their investment vehicles extremely low. It may also apply for those that are newer to investing or have lower account balances, as it’s a more simplified approach with fewer overall holdings.

Within our A+B portfolios, that’s where we combine cap-weighted and fundamental index exposure in a way that for a slight additional cost, we think it’s better together. It can potentially add more diversification and smooth out the volatility in a portfolio. Clients who are comfortable with the opportunity to deviate somewhat from the market may find these attractive. Combining cap-weighted and fundamental has shown an opportunity for enhanced results, be it after a market bubble bursts, time when maybe value investments are leaning in favor. We balance the exposure to both capture the market to a large degree and provide that diversification that can help limit overexposure to market cap indices.

And lastly, ABC. That’s where we layer in active management. We provide some ideas and starting points for advisors to consider how much passive exposure should they have relative to their active exposure and their overall risk budget. These portfolios may be most appropriate for clients who are seeking out performance to a larger degree, they’re comfortable with active management and their ability to outperform over market cycles, and they have less concern about their tracking on a day-to-day basis relative to the market. All three together can really help smooth out the volatility in good times and tough times in the market.

JENNA: Finally, Jake, how can advisors leverage your team, and the asset allocation insights and resources from Schwab Asset Management?

JAKE: Our team seeks to provide advisors with tailored support based on their unique needs, whether that’s as a thought partner, providing model portfolio evaluations, comparing and contrasting their approach relative to ours or other approaches to identify opportunities for improvement. We offer model portfolios, as well, that leverage the ABC asset allocation framework we’ve discussed. They can take those and use them directly with their clients, or they can take the allocations and adapt them for their own use. We’ve seen advisors leverage the frameworks in large part, but then have their own, you know, special expertise embedded, and they can call on us to provide analytics to support those decisions, or if we find issues with those, we can raise this as well. And lastly, we have a robust lineup of individual products and solutions that advisors can use in their existing portfolios if they so choose.

JENNA: Well, Jake, it was great to have you with us, and thank you to everyone watching. Once again, that was Jake Gilliam, Managing Director and Head of Portfolio Construction Solutions supporting Schwab Asset Management. And I’m Jenna Dagenhart with Asset TV.

Disclosures

This information is intended for use only by financial advisors, with other information, as a resource to help build a portfolio or as an input in the development of investment advice for their own clients. Such financial advisors are responsible for making their own independent judgment as to how to use this information, and only clients and their advisors know enough about their financial circumstances to make investment decisions. Schwab Asset Management does not have investment discretion over or place trade orders for any portfolios or accounts derived from this information. There is no guarantee that any investment strategy illustrated will be successful or achieve any particular level of results.

For institutional use only.