Forward/Backward: 2025 Review With a Note on Venezuela

Key takeaways

- Venezuela's Nicolas Maduro was captured by U.S. forces over the weekend, prompting many questions around what the intentions are for the country's potential path back to democracy, its vast oil reserves, and standing with other major global producers.

- Early market action from Sunday evening into Monday morning suggests global investors are not perturbed by the events in Venezuela: the dollar moved higher, equity futures climbed, and oil prices declined.

- A review of markets in 2025 underscores that it was a year defined by massive churn and volatility—evidenced by the S&P 500's double-digit percentage for the year, paired with a near-bear market and only two of the seven "Magnificent 7" members outperforming the index.

- Venezuela's Nicolas Maduro was captured by U.S. forces over the weekend, prompting many questions around what the intentions are for the country's potential path back to democracy, its vast oil reserves, and standing with other major global producers.

- Early market action from Sunday evening into Monday morning suggests global investors are not perturbed by the events in Venezuela: the dollar moved higher, equity futures climbed, and oil prices declined.

- A review of markets in 2025 underscores that it was a year defined by massive churn and volatility—evidenced by the S&P 500's double-digit percentage for the year, paired with a near-bear market and only two of the seven "Magnificent 7" members outperforming the index.

Happy New Year, everyone. This week's missive is a review of the year just past, but for obvious reasons, we want to open it with some thoughts from the full team at Schwab Center for Financial Research (SCFR) on the events that have unfolded in Venezuela.

What happened?

Over the weekend, President Trump announced that Venezuelan President Nicolas Maduro was captured during a large-scale U.S. strike that began on January 2, and he and his wife were subsequently transported to New York. Maduro faces drug trafficking and narco-terrorism charges, with Trump saying the United States would run the country (at least temporarily) and take control of Venezuela's oil reserves.

Our 2026 outlook had a theme of instability (in contrast to the simpler "uncertainty" descriptor). The events that have unfolded in Venezuela certainly fit that bill. International reactions are sharply divided, and the story is still unfolding. We would caution investors not to make knee-jerk portfolio decisions. Based on history (more on that below), we believe the equity market should look through the headlines; but could key off moves in the bond market.

Our initial take is that, in isolation, what has unfolded in Venezuela is a more significant geopolitical event than a market event. Typically, geopolitical risk is transmitted to global markets via oil prices. We have trotted out the table below in the past showing how these types of events have rarely had a lasting impact on the stock market. Worth noting is that in the most severe case in 2001, the U.S. was already in the middle of a severe bear market, caused by the bursting of the internet bubble.

Military conflicts have rarely caused large negative returns for U.S. equities

Cumulative returns of the S&P 500 since the conflict's start date

| Conflict (start date) | 1 month | 3 months | 6 months | 9 months | 12 months |

|---|---|---|---|---|---|

| WWII (9/1/39) | 14% | 9% | 8% | -17% | -6% |

| Korean War (6/25/50) | -9% | 2% | 5% | 12% | 13% |

| Vietnam War (11/1/55) | 7% | 3% | 14% | 17% | 8% |

| Afghan War (4/27/78) | 0% | 2% | -1% | 5% | 5% |

| Persian Gulf War (1/16/91) | 18% | 22% | 22% | 25% | 34% |

| Bosnian Conflict (4/6/92) | 4% | 3% | 1% | 8% | 10% |

| Kosovo Conflict (2/28/98) | 5% | 4% | 7% | 5% | 18% |

| War in Afghanistan (10/7/01) | 4% | 9% | 5% | -8% | -25% |

| Iraq War (3/20/03) | 2% | 14% | 19% | 25% | 27% |

| Syrian Civil War (3/15/11) | 1% | -1% | -8% | -7% | 8% |

| Russian Invasion of Ukraine (2/24/22) | 5% | -6% | -2% | -5% | -5% |

| Israel-Hamas War (10/7/23) | 1% | 9% | 21% | 29% | 33% |

One important reminder is that Venezuela is a small global player and oil producer. Around 50 years ago, it represented roughly 1% of global gross domestic product (GDP), a share that has now fallen to barely 0.1%. Global oil production rings in at about 80 million barrels per day (bpd), with inventory building at a rate of 2 million bpd, as estimated by the Energy Information Agency (EIA). Venezuela produces only 800 thousand bpd (of "heavy crude")—ranking it 17th among global producers. Contrast that with U.S. production of more than 13 million bpd, and Saudi Arabian and Russian production of about 10 million bpd. All else equal, a major disruption in Venezuelan oil production (in either direction) will have less of an impact on oil prices. Questions abound as to the impact on China's energy needs, but their needs can largely be met by Russian, Iranian, and open-market oil supplies.

Venezuela does have the highest proven oil reserves at about 303 billion barrels, according to the Organization of the Petroleum Exporting Countries (OPEC)—surpassing those of Iran, Canada, Iraq, Kuwait, and Saudi Arabia. However, there is limited current infrastructure in place to harvest those reserves due to decades of underinvestment in response to sanctions. Early reports indicate that Venezuela's infrastructure was apparently not damaged during the strike.

It's premature to lay out a long-term assessment of the oil market given that it will take quite a bit of time (and money) to significantly boost production there. Will the prospect alone of a supply increase down the road lower oil prices today? Or, is there a risk that production declines in the short run given the instability?

Market(s) outlook

Despite a somewhat hazy outlook, we think the oil market could respond with prices falling sharply in the "back months" (late-2026 and into 2027) on anticipation of lower prices due to increased supply. "Front months" (nearer term) likely won't be affected as much since it will take time (possibly years) for Venezuelan heavy crude to hit the market. Also, a drop in near-term prices could be limited by OPEC's decision to cut supplies until it can convene an emergency meeting. This uncertainty could weigh on the direction of long-term Treasury yields which, in turn, could translate to equity market volatility.

We expect limited impact on the near-term decision-making by the Federal Reserve given the fluidity of the situation. However, if it looks like oil prices will trend lower and thus lead to lower gasoline prices, it would help ease the ongoing inflation problem and possibly set the stage for easier monetary policy. All else equal, this would be positive for the stock market.

This is not a risk-free assessment, however. We may witness some risk-off market behavior if investors believe the United States is considering taking any similar action in other countries—not to mention the fact that the U.S. has struggled with regime change in the past (in Iraq, Afghanistan, and Libya, for example). So far, signals from markets on Sunday evening into Monday morning were broadly positive with S&P 500 futures up by 0.2%, the dollar climbing by 0.3%, Treasury yields down marginally, and Brent crude oil down by nearly 2% at its worst point (before paring its losses later in the morning on Monday, January 5) —all to suggest this is not (yet?) a major market event.

Meanwhile, back at the 2025 review ranch

Before we were crudely interrupted, this week's missive was to be a year-in-review, so let's get to that. We'll keep this brief as the visuals do most of the "talking."

Churn was the name of the game

Below is a summary of returns for the major U.S. equity indexes. 2025 brought stellar performance at the index level—especially for the NASDAQ and S&P 500—but there was notable drama throughout the year as well as under the surface of the cap-weighted index returns. As a reminder, the S&P 500 suffered a near-bear market between mid-February and early-April; followed by a largely-gangbusters rally since the April 8 closing low. However, as shown in the last column, even during that run, the average member within each of the indexes experienced some drama.

Major indexes and maximum drawdowns

| Index | Index 2025 return | Index maximum drawdown from YTD high | Average member maximum drawdown from YTD high | Index return since 4/8/25 low | Index maximum drawdown since 4/8/25 low | Average member maximum drawdown since 4/8/25 low |

|---|---|---|---|---|---|---|

| S&P 500 | 16% | -19% | -27% | 37% | -5% | -19% |

| NASDAQ | 20% | -24% | -52% | 52% | -8% | -43% |

| Russell 2000 | 11% | -24% | -41% | 41% | -9% | -30% |

From Mag7 to Lag5

The obsession over the Magnificent 7 (Mag7) group of stocks faded throughout the year, with only two—Alphabet and NVIDIA—outperforming the S&P 500. There's a very important message imbedded in the table below. Although NVIDIA remains the top-ranked contributor to S&P 500 index returns, it was ranked only 75th in terms of price performance. In other words, it's not the best price performer … it's the top contributor by virtue of the multiplier of its huge cap size. Keep that in mind when thinking about concentration in your own portfolios. There are more fish in the market sea than just a small handful of stocks.

2025 Magnificent 7 Performance

| - | 2025 return |

S&P 500 Performance rank |

S&P 500 Contribution rank |

NASDAQ Performance rank |

|---|---|---|---|---|

| Alphabet Inc | 65% | 28 | 2 | 405 |

| NVIDIA Corp | 39% | 75 | 1 | 617 |

| NASDAQ | 20% | NA | NA | NA |

| S&P 500 | 16% | NA | NA | NA |

| Microsoft Corp | 15% | 165 | 7 | 952 |

| Meta Platforms Inc | 13% | 183 | 18 | 996 |

| Tesla Inc | 11% | 200 | 26 | 1022 |

| Apple Inc | 9% | 229 | 8 | 1088 |

| Amazon.com Inc | 5% | 264 | 33 | 1208 |

Sector swings

It was a wild ride for sectors last year, notwithstanding the top ranking for perennial crowd sector favorites, Communication Services and Technology. Those two underscore an important aspect of returns vs. rank. Despite Tech being the top performer in six out of 12 months, and Communication Services only being the top performer in one month, it was the latter that bested the former by nearly 10 percentage points by the end of the year. For our current sector ratings, see this report.

Mega-cap dominance in 2025

Source: Charles Schwab, Bloomberg, as of 12/31/25.

Sector performance is represented by price returns of the following 11 Global Industry Classification Standard (GICS®) sector indices: Consumer Discretionary Sector, Consumer Staples Sector, Energy Sector, Financials Sector, Health Care Sector, Industrials Sector, Information Technology Sector, Materials Sector, Real Estate Sector, Communication Services Sector, and Utilities Sector. Returns of the broad market are represented by the S&P 500. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Go global!

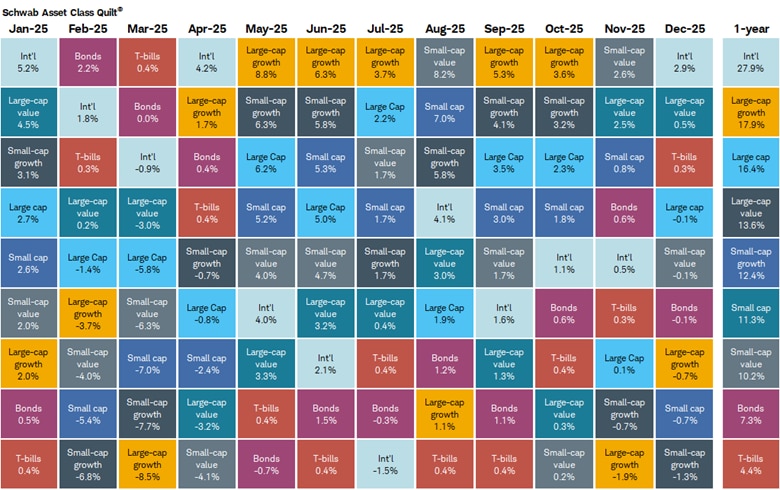

We have espoused the merits of international equity diversification for the past few years. For a while there, doing so often required saying "we're sorry." After last year, perhaps we can now say "you're welcome." As shown below in the asset class quilt, international stocks outperformed all other major asset classes last year; with small-cap value bringing up the rear in the equity universe. Yet again, you can see how rank vs. return comes into play: Large-cap growth was the top performer in five out of 12 months, while international was the top performer for a total of three months, yet it was the latter that outperformed by 10 percentage points. For Schwab's international outlook, see here.

International pulls ahead in 2025

Source: Charles Schwab, Bloomberg, as of 12/31/2025.

Asset class performance is represented by price returns of the following indices: S&P 500® Index (Large cap), Russell 1000® Growth Index (Large-cap growth), Russell 1000® Value Index (Large-cap value), Russell 2000® Index (Small cap), Russell 2000® Growth Index (Small-cap growth), Russell 2000® Value Index (Small-cap value), MSCI EAFE® Index (international stocks, "Int'l"), Bloomberg US Aggregate Bond Index (Bonds), and FTSE U.S. 3-month Treasury Bill Index (T-bills). Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

In sum

While the situation in Venezuela remains in flux and will undoubtedly continue to shift moving forward, global markets have thus far taken the news in stride. From here, much will depend on the degree of the U.S.' involvement in Venezuela's future path, how larger oil producers outside of both countries will respond, and whether the energy market has a tantrum. In keeping with the aforementioned table showing the stock market's response to major geopolitical events, we continue to think diversification and staying invested are the best safeguards against any unsettling developments. That is in keeping with the relatively strong base from which markets are starting this year, given broad-based gains in 2025 and relatively healthy breadth.