Understanding Your Fund's Tax Cost Ratio

As the year winds down, many investors begin to assess the tax implications of their portfolios. One metric that can help evaluate the tax efficiency of investment funds is the "tax cost ratio" (TCR). It measures how much of a fund's annualized return is reduced by the taxes investors pay on distributions. It assumes the investor is in the highest tax bracket and investing through a taxable account.

Below we'll discuss why TCR matters, which types of funds are likely to be more tax-efficient, and how investors can research fund TCRs using tools available at Schwab.

Why tax cost ratio matters

Mutual funds and exchange-traded funds (ETFs) are required to distribute nearly all of their income and capital gains annually to maintain their status as regulated investment companies (RICs). These distributions can trigger taxable events for investors and are typically classified as:

- Qualified dividends: Generally, these are dividends from U.S. stocks and qualifying foreign stocks that meet holding period requirements at both the fund and investor levels. If a dividend meets all of the IRS's qualified dividend requirements, it's eligible to be taxed at lower capital gains rates.

- Ordinary income: Income that does not meet the criteria for qualified dividends is taxed as ordinary income. This includes interest payments from bonds, most distributions from real estate investment trusts (REITs), dividends from foreign stocks located in countries without U.S. tax treaties, securities lending revenue, and gains from investing in futures, swaps, and other types of derivatives.

- Capital gains: When a fund sells an asset for more than its cost basis, it generates a capital gain. Short-term capital gains are profits from assets owned for a year or less and are usually taxed at ordinary income rates. Long-term capital gains are profits from assets owned for more than a year and are usually taxed at lower long-term capital gains rates.

Funds that distribute all income and capital gains to shareholders each year (and meet other IRS RIC requirements) are considered to be pass-through entities. These funds are not required to pay taxes at the fund-level. Instead, they pass through the character of their distributions to shareholders, and shareholders will owe taxes based on the types of events that occurred inside the fund (i.e., qualified dividends, ordinary income, short-term or long-term capital gains).

Active vs. passive strategies and fund structures

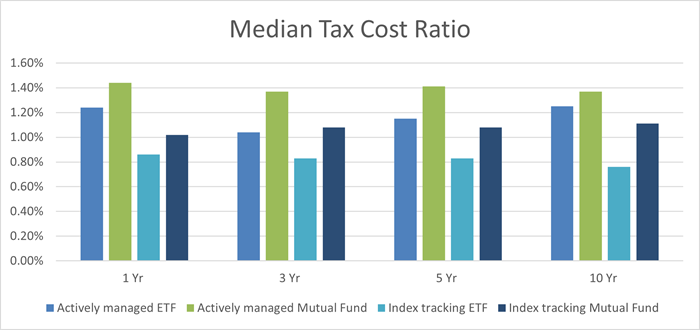

The following analysis is based on data from Morningstar and includes TCRs greater than zero for more than 22,000 U.S. mutual funds and ETFs. This data reveals clear trends in tax efficiency across fund types:

- Actively managed funds tend to have higher TCRs—likely due to more frequent trading, which tends to generate more taxable gains.

- Index funds, which often have lower turnover, generally have lower TCRs.

- ETFs also tend to benefit from in-kind, share creation/redemption mechanisms that can help reduce the need to sell securities—leading to fewer capital gains.

Actively managed funds tend to have higher tax cost ratios

Source: Schwab Center for Financial Research, Morningstar Direct as of 10/30/2025.

Data set contains 2,678 actively managed ETFs, 16,176 actively managed mutual funds (represented by oldest share class), 3,047 index tracking ETFs, and 704 index tracking mutual funds (represented by oldest share class). TCRs are only included when greater than zero. Does not include ETFs in inverse, leveraged or trading - miscellaneous categories.

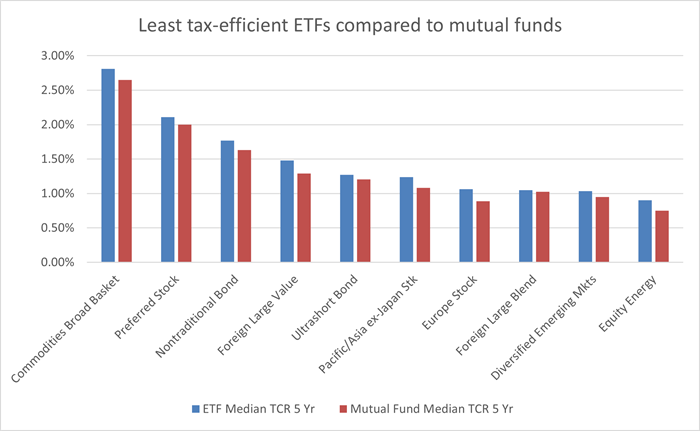

However, like median age or median income, median TCR can also be overgeneralized. Some Morningstar categories tend to have much higher TCRs than others due to high turnover and investments in securities that generate ordinary income (e.g., bonds, foreign stocks, futures contracts, and other derivatives).

Additionally, funds in the energy limited partnership category are often taxed at the fund level due to their investments in master limited partnerships (MLPs), which are not considered to be qualifying sources of income for RICs. The following table contains the Morningstar categories with the highest five-year TCRs for categories with at least 10 funds.

Morningstar categories with highest five-year TCRs

Conversely, the funds with the lowest TCRs are usually found in the municipal bond categories as these funds tend to have relatively low turnover and generate income that is exempt from federal tax and may also be exempt from state and local taxes.

Although ETFs are often more tax efficient than mutual funds, in some Morningstar Categories, ETFs can have TCRs as high or higher than those of mutual funds. In these categories, ETFs tend to have high turnover, invest in securities that are taxed at ordinary income rates, and forego the use of in-kind creation and redemption—instead they engage in taxable cash transactions with authorized participants (APs). All of these activities reduce their tax advantages compared to mutual funds. The following chart shows Morningstar Categories where the median TCRs are higher for ETFs than for mutual funds.

Least tax-efficient ETFs compared to mutual funds

Source: Schwab Center for Financial Research, Morningstar Direct as of 10/30/2025.

Data set contains 2,678 actively managed ETFs, 16,176 actively managed mutual funds (represented by oldest share class), 3,047 index tracking ETFs, and 704 index tracking mutual funds (represented by oldest share class). TCRs are only included when greater than zero. Does not include ETFs in inverse, leveraged or trading - miscellaneous categories.

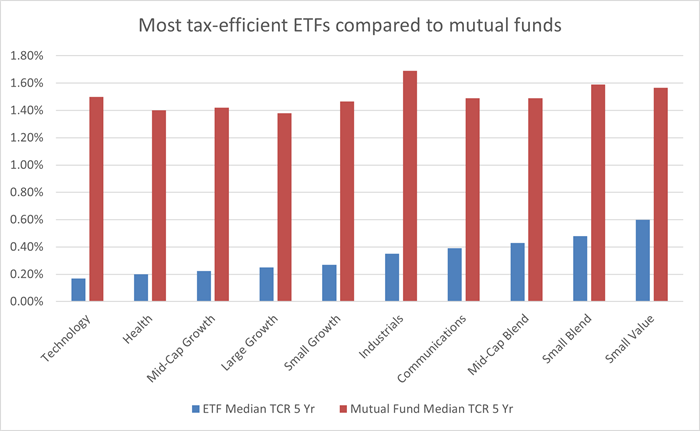

Conversely, in U.S. equity categories where the ETFs tend to track low-turnover indexes and make dividend distributions that are primarily qualified (as opposed to non-qualified), the tax efficiency of ETFs is on full display.

Most tax-efficient ETFs compared to mutual funds

Source: Schwab Center for Financial Research, Morningstar Direct as of 10/30/2025.

Data set contains 2,678 actively managed ETFs, 16,176 actively managed mutual funds (represented by oldest share class), 3,047 index tracking ETFs, and 704 index tracking mutual funds (represented by oldest share class). TCRs are only included when greater than zero. Does not include ETFs in inverse, leveraged or trading - miscellaneous categories.

In summary, understanding TCRs may be helpful for maximizing after-tax returns. While actively managed mutual funds often carry the highest TCRs, ETFs can also exhibit elevated TCRs depending on their structure and investment strategy.

Plus, while tax considerations are important, investors should also consider other factors—including fees and expenses, investment objective, risk profile, and fund performance—when evaluating funds.

What to consider now

TCRs are one of several factors to consider when selecting funds. In certain categories, ETFs tend to demonstrate greater tax efficiency vs. mutual funds, but this isn't always the case. While TCR offers useful insights, tax efficiency should be considered alongside other investment criteria, such as fees and expenses, investment objective, risk profile, and fund performance.

Investors can research TCR data, provided by Morningstar, for thousands of funds via Schwab's Research pages. Go to the Research Tools tab, then choose ETF Research or Mutual Funds Research depending on the type of fund you're researching. For ETFs, TCRs can be found under the "Tax Analysis" tab, and for mutual funds it can be found under "Risk & Tax Analysis."