Chart in a Minute

Use these simple visuals to help illustrate technical market perspectives to clients.

Investment-grade corporate bonds—is now the right time for clients?

September 10, 2025

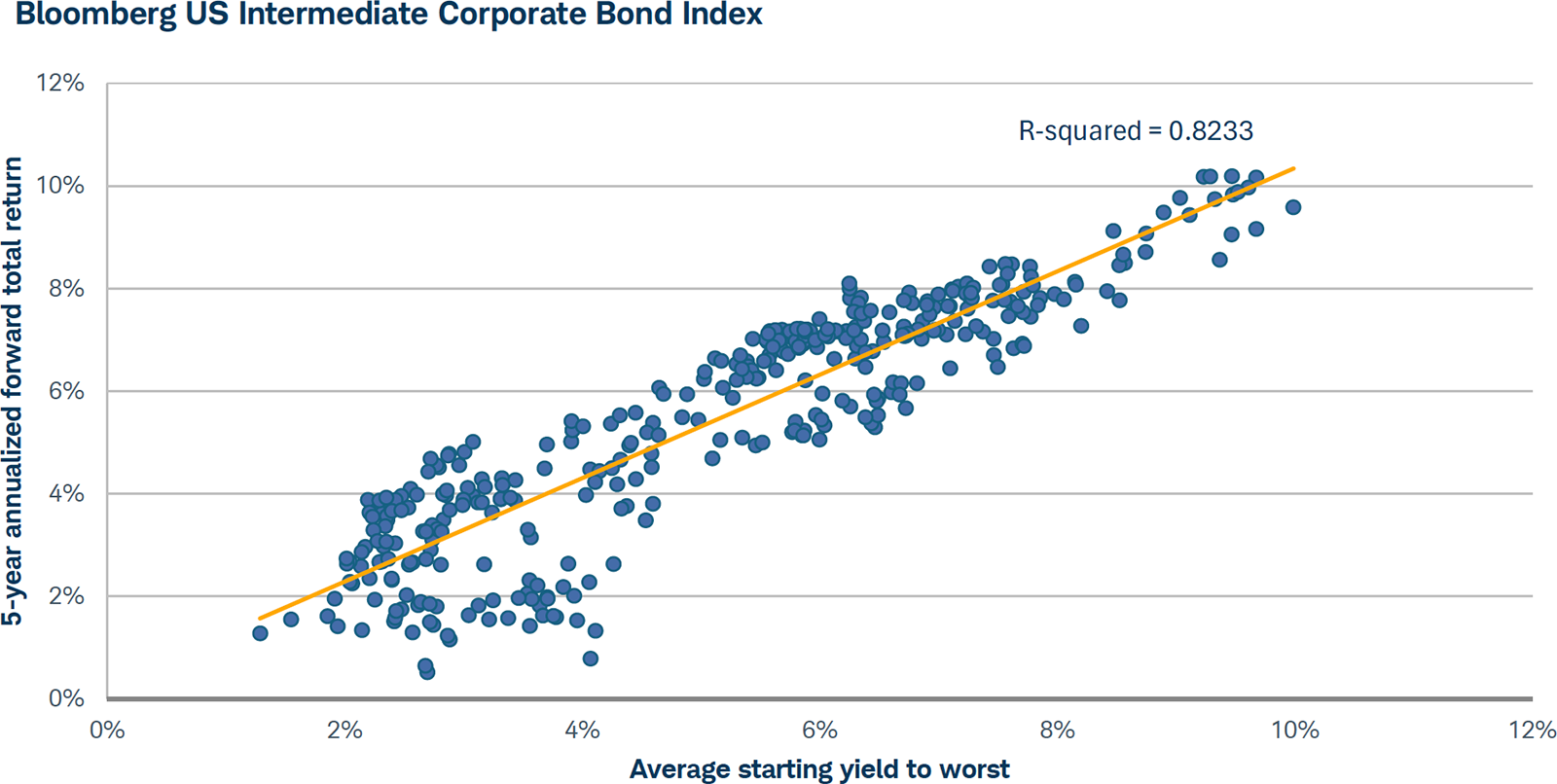

Investment-grade corporate bond yields are near the upper end of their 15-year averages, and starting yields tend to be good indicators of future returns.

Key takeaways:

- If your clients need more fixed income, consider talking with them about investment-grade corporate bonds. Average yields on these securities with intermediate-term maturities currently range from 4.25% to 5.50%.1

- Moreover, as this scatter plot illustrates, a close relationship has historically existed between starting yields on investment-grade corporate bonds and their subsequent five-year average annual total returns.

- Given that investment-grade corporate bond yields are currently near the higher end of their 15-year range, now may be the right time to talk with clients about this opportunity.