Charles Schwab Trust Bank Collective™ Investment Trust target date solutions

Pooled investment target date trusts exclusively for qualified retirement plans.

Our approach

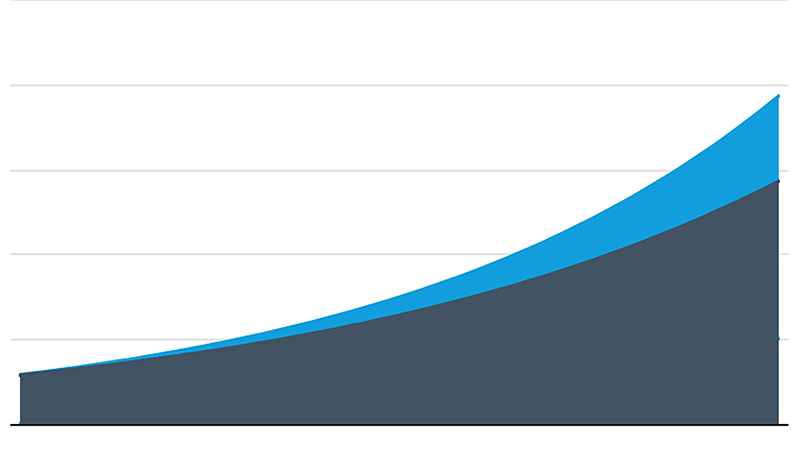

Schwab Trust Bank takes a behavioral-based approach to glide path design—focused on recognizing and reducing risks along the way to retirement and beyond—that leverages Schwab Asset Management’s investment research and deep asset allocation expertise. The products provide a carefully designed and balanced glide path using industry-recognized sub-advisors to provide institutional investment management benefits to plan participants.

What we offer

We offer access to blend and passive target date trusts for qualified retirement plans. Our innovative target date trusts are comprehensive portfolios designed for the needs of individual investors in mind and to the highest fiduciary standards. Our trusts are maintained by Charles Schwab Trust Bank and have leveraged Schwab Asset Management's expertise to assist in their management since 2002.1

Differentiators

- Real-world glide path

- Holistic portfolio construction

- Comprehensive risk management

Benefits

- Designed to help investors and plan participants stay invested across market conditions

- Seek to minimize behavioral and investment risks throughout the investment cycle

- Low-cost focus