Schwab Personalized Indexing®

Your clients can now have a professionally managed strategy that is tax optimized and can be customized as a core component of their portfolio.

What advisors should know about Schwab Personalized Indexing®

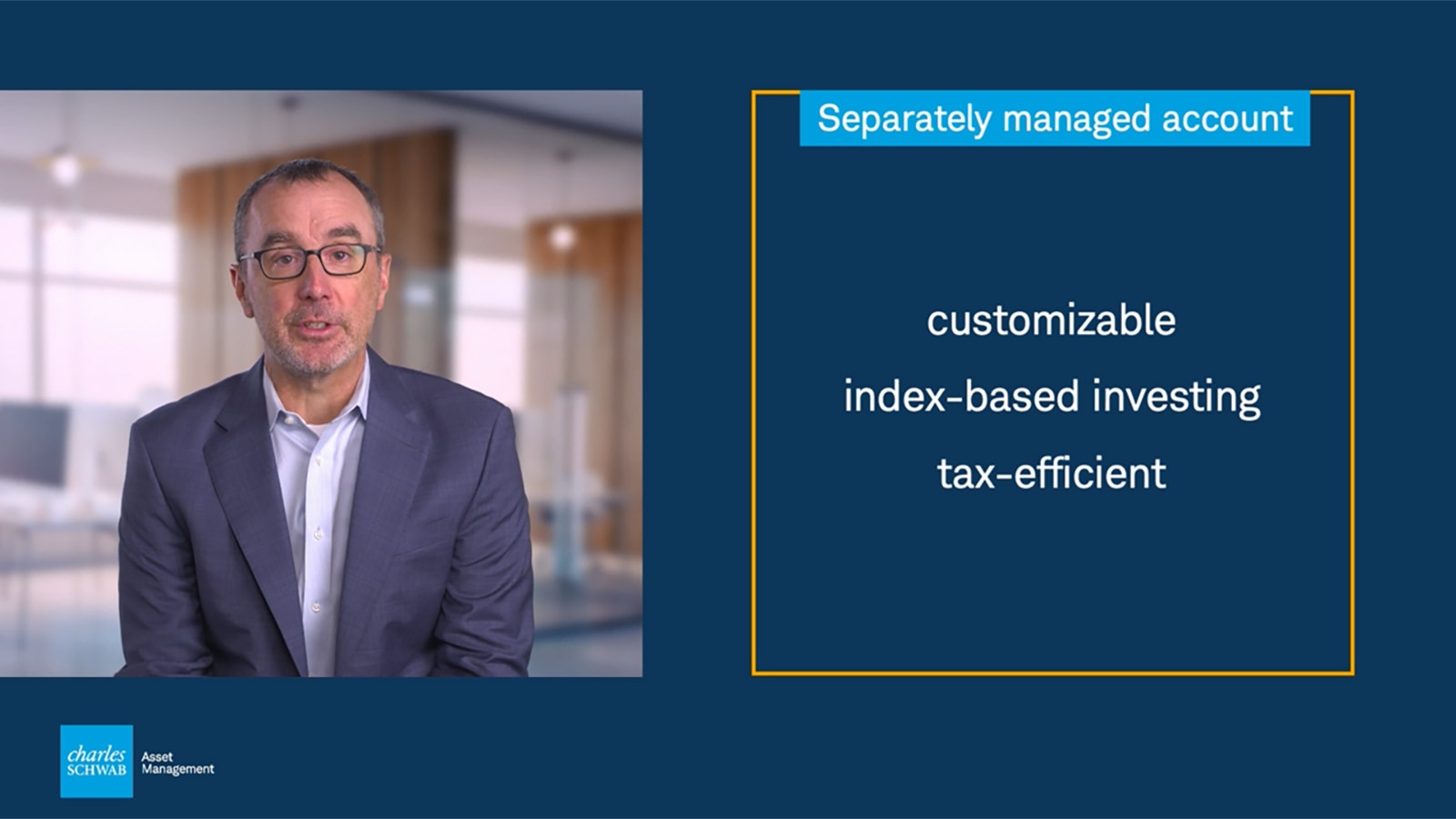

Watch this short video to understand how Schwab Personalized Indexing takes index investing to the next level.

JEFF BROWN: Hi, I’m Jeff Brown, Investment Portfolio Strategist at Charles Schwab. In this short video, I’m going to talk about Schwab Personalized Indexing®, an advisor-led solution from Schwab Asset Management. It’s a separately managed account that offers customizable, index-based investing with tax-efficient management. It’s straightforward, cost-effective, easy to implement, and easy to scale. With an account minimum of just $100,000, Schwab Personalized Indexing makes direct indexing accessible to a wide range of investors. We offer access to several different index strategies, enabling clients to select the market coverage that best fits their overall portfolio. Let’s take a closer look at some of the key benefits of this offer.

First, Schwab Personalized Indexing is tax-efficient. Using a process called tax loss harvesting, it monitors each client’s account daily to look for opportunities to lock in tax losses to offset gains, thereby helping to potentially increase a client’s after-tax return.

Second, it’s customizable. The advisor and client select one or more of the offered indices, and they can personalize the accounts by excluding individual securities, sub-industries, and industries. This customization and personalization can help investors identify with the investment strategy and possibly stay committed to the strategy for longer timeframes, all while taking into account stocks or groups of stocks the client does not want to hold or add to, like their company stock.

And third, it’s professionally managed. Our Portfolio Management team leverages advanced technology to optimize each client’s portfolio, and monitor it daily, freeing up the advisor’s time to tend to other aspects of the client’s portfolio and their experience.

If you think Schwab Personalized Indexing might be a good fit for your clients, please reach out to your Schwab representative. We look forward to hearing from you.

Disclosures

For institutional use only - not for further distribution.

This information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice.

Please refer to the Charles Schwab Investment Management, Inc. Disclosure Brochure for additional information.

Portfolio Management for Schwab Personalized Indexing is provided by Charles Schwab Investment Management, Inc., dba Schwab Asset Management®, a registered investment adviser and an affiliate of Charles Schwab & Co., Inc. (“Schwab”). Both Schwab Asset Management and Schwab are separate entities and subsidiaries of The Charles Schwab Corporation.

Diversification and asset allocation strategies do not ensure a profit and cannot protect against losses in a declining market.

Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly.

There are risks associated with any investment approach, and each Schwab Personalized Indexing strategy and equity market segment has their own set of risks based on client strategy selection and further customization.

Neither the tax-loss-harvesting strategy nor any discussion herein is intended as tax advice, and Schwab Asset Management does not represent that any particular tax consequences will be obtained. Tax-loss harvesting involves certain risks including unintended tax implications. Investors should consult with their tax advisors and refer to the Internal Revenue Service (“IRS”) website at www.irs.gov for the consequences of tax-loss harvesting.

Strategies that use screening to exclude certain investments may not be able to take advantage of the same opportunities or market trends as strategies that do not use screens. There can be no assurance that the strategies will achieve their desired outcomes. There can be no assurance that the strategies will achieve their desired outcomes. Each investing strategy brings with it its own set of unique risks and benefits.

SAM (1025-HEFE)

An index-based portfolio your clients can personalize

Schwab Personalized Indexing is designed to be a core component of your client’s investments. It gives them an equity portfolio that can be shaped to be consistent with their goals and personal values.

Customizable

- Choose from six index-based strategies for the market exposure your client prefers, with the ability to exclude individual stock and/or industry categories.1

Professionally managed

- Portfolio managers leverage advanced technology to optimize your client’s portfolio and monitor it on a daily basis.

Tax efficient

Schwab Personalized Indexing can serve as a tax-efficient foundation for your client’s portfolio. With the ability to automatically manage gains and losses at the individual holding level, each direct indexing strategy provides tax-loss harvesting and potentially greater annual after-tax returns (or Tooltip ).

1 The extent to which holdings can be personalized is subject to account type and investment management guidance. All accounts may exclude up to three securities

* While this strategy looks to approximate the pre-tax return and risk characteristics of the MSCI EAFE Index, it will not invest directly in the local securities tracked by the index and will instead invest in American Depositary Receipts (ADRs) that are traded on U.S. Exchanges which may not align to the index exposure of every country at all times.

Ready to talk?

Find your regional representative who can answer any questions you have about Schwab Personalized Indexing and the SMAs we offer.