9 key questions to ask an ETF provider

Introduction

Culture. Commitment. Consistency. Many advisors select exchange-traded funds (ETFs) based on the underlying asset class and fund-specific attributes. But the ETF provider is also important to the long-term success of the investment. When choosing ETFs for your clients, look for a provider who has clearly displayed the culture, commitment, and consistency worthy of a long-term relationship.

Here are nine questions to help you evaluate ETF providers:

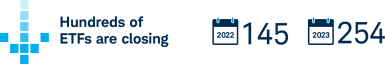

#1 What is the provider’s history with ETF closures?

In the past two years, hundreds of ETFs were closed by their providers. Fund closings tend to be bad news for shareholders, who may walk away with less than the net asset value (NAV) of their shares or who may be stuck with a tax bill for embedded gains.

In lieu of closings, many ETF providers continue to carry funds that are not actively trading in the secondary market and thus have minimal liquidity.

Ask the provider to detail their history of ETF closures. Also, do they currently have any ETFs that are languishing and at risk of closing? These could be red flags for potential investors.

Source: ETF.com, ETF Watch Tables, “ETF Closures.”

#2 How tax efficient are the provider’s ETFs?

Potential tax efficiency is one of the most significant benefits of the ETF structure. Unlike mutual funds, ETFs typically do not have to sell their holdings to meet shareholder redemptions or manage index rebalancing. This can help to minimize capital gains.

Since passive ETFs track indices, their holdings tend to have less turnover than actively managed mutual funds. This further reduces the need for distributions. But in the world of ETFs, some providers have a better track record than others when it comes to tax efficiency of their ETFs.

Before selecting an ETF, ask the provider about their track record for distributing capital gains.

Capital gain distributions, by provider

| Provider | # of ETFs | Assets ($B) | # of ETFs paid capital gains in 2021 | # of ETFs paid capital gains in 2022 | # of ETFs paid capital gains in 2023 |

|---|---|---|---|---|---|

| BlackRock | 424 | 2,587 | 29 | 22 | 4 |

| Vanguard | 86 | 2,353 | 12 | 4 | 0 |

| State Street | 139 | 1,222 | 6 | 1 | 0 |

| Invesco | 221 | 457 | 34 | 7 | 1 |

| Charles Schwab | 30 | 319 | 0 | 0 | 0 |

| First Trust | 223 | 153 | 1 | 13 | 0 |

| JPMorgan | 59 | 130 | 12 | 5 | 0 |

| Dimensional | 38 | 118 | 2 | 0 | 0 |

| WisdomTree | 76 | 72 | 10 | 7 | 2 |

| ProShares | 143 | 69 | 3 | 4 | 1 |

| VanEck | 69 | 67 | 1 | 0 | 0 |

| Fidelity | 67 | 52 | 12 | 9 | 2 |

| Global X | 107 | 42 | 31 | 24 | 9 |

| Direxion | 80 | 38 | 1 | 13 | 2 |

| Pacer | 46 | 35 | 0 | 5 | 0 |

| Total | 1808 | 7,715 | 154 | 114 | 21 |

Source: Morningstar as of December 31, 2023.

These are estimates. Actual payment of capital gains may be different.

#3 How liquid are the provider’s ETFs?

When an ETF is bought or sold, there is a difference between the highest price a buyer is willing to pay for a share and the lowest price a seller is willing to accept for a share. This is known as the bid-ask spread—and it is a common measure of an ETF’s liquidity.

The amount of the spread varies from one ETF to another. While many complex factors drive bid-ask spreads, trading volumes and the size of the fund play a key role. Spreads tend to be greater for ETFs with low trading volumes, such as those that track the performance of niche assets. Larger funds with more liquid underlying assets are more likely to trade with ample liquidity.

To evaluate the liquidity of an ETF, ask the provider:

- How does the fund’s bid-ask spread compare with those of similar funds?

- What is the average daily trade volume of the ETF in dollars?

- How close does the ETF trade to its NAV?

#4 What is the provider’s product philosophy?

Ask the provider to articulate their product goals and priorities. Do they seek to be the low-cost provider? Provide niche exposures? Offer active management via ETFs?

Think about what you’re looking for on behalf of your clients. You may be willing to pay more for specialized expertise. Or you may want a low-cost core portfolio.

#5 How committed to the ETF business is the provider?

The booming popularity of ETFs has led many asset managers to enter the business—some perhaps haphazardly. Many have rolled out ETFs without a distinct strategy, introduced flashy unproven strategies, or bolted on an ETF capability by purchasing a small provider.

Running a successful ETF product line requires extensive expertise and a commitment of significant resources. Without these, ETFs may fail to thrive, experience poor liquidity, and end up closing. In all those cases, their investors will pay the consequences.

Ask the provider whether they are devoting the necessary resources to their ETF family. They should be able to point to an experienced portfolio management team, a dedicated capital markets desk, an ETF product management team, and a distinct marketing capability. Before you sign on, find out how long they have managed ETFs and their total ETF assets under management.

#6 Does the provider have an established strategic beta product line?

Whether they’re called strategic beta, smart beta, factor-based investing, or some other name, ETF strategies that move beyond the market-cap index approach have become popular in recent years. These investment styles may add value and deliver uncorrelated returns to a portfolio, serving as a complement to both market-cap indexing and active management.

In order to meet market demand, more and more providers are rolling out strategic beta products. But these strategies are not all created equal. There can be sharp differences between product complexity, fees, the return patterns of the various strategies, and levels of assets under management.

Ask the provider for the track record of their strategic beta funds. Along with the objective of the fund, evaluate the size of the funds and their expense ratios relative to other strategic beta ETFs to choose those that best fit your needs.

#7 Does the provider profit from securities lending in their ETFs?

Many ETF providers elect to lend securities held by their funds to other market participants, such as short sellers. In return, they receive collateral and a loan fee.

Some providers keep a portion of the fee income for themselves. Alternatively, some ETF providers return all of the revenues, net of expenses, from securities lending to the ETF, which may enhance fund returns.

Ask the provider about their securities-lending philosophy and practice, and whether they take an investor-first approach.

#8 How do the provider’s expense ratios compare with their peers’?

One of the attractive features that leads advisors to utilize ETFs is the lower fee ETFs generally charge compared with mutual funds.

Comparing providers on the basis of cost is a critical part of the due diligence process. Ask how their expense ratios compare with those of the lowest-cost funds in the same investment categories. Some providers compete on pricing in just a few ETFs but carry higher prices in older funds.

Ask the provider about their pricing philosophy. Consider choosing a firm with a demonstrated strategy of competitive pricing across their whole ETF product line.

Morningstar as of October 3, 2024

#9 How transparent and consistent is the provider?

Transparency has been a key benefit for index and transparent active ETFs. Many advisors appreciate seeing the underlying holdings of their ETFs in real time. Precise and timely holdings information is helpful for assembling portfolios to see if any holdings overlap and to calculate aggregated factor exposures. Most—but not all—ETF providers offer daily disclosure of their index fund holdings. Does yours? If not, ask why.

Another important way to distinguish between ETF providers is to evaluate the index providers of the indexes that their ETFs track. Is the index provider high quality, with sufficient brand recognition and depth of resources? Does the ETF provider demonstrate consistency with regard to its index providers and strategies? Or has the firm changed indices or strategies, leaving advisors guessing what could come next?

It’s important to note in 2020, the first non-transparent ETFs (also called semi-transparent ETFs) were approved and introduced to the market. This new type of ETF allows for actively managed funds to seek to deliver some of the traditional benefits of ETFs, such as intraday liquidity and tax efficiency, but not holdings transparency. Masking some or all of the portfolio holdings allows the manager to keep their investment decisions private. The daily transparency of traditional ETFs has been an impediment for many actively managed strategies that could be at risk of diminished returns if competing funds or arbitragers seek to benefit from timely knowledge of investment changes.

For traditional index ETFs, the benefit of transparency remains a helpful aspect. Advisors can now weigh the relative benefit of this feature against the potential benefits of actively managed strategies in the non-transparent ETF vehicle.

9 key questions to ask when evaluating an ETF provider

- What is the provider’s history with ETF closures?

- How tax efficient are the provider’s ETFs?

- How liquid are the provider’s ETFs?

- What is the provider’s product philosophy?

- How committed to the ETF business is the provider?

- Does the provider have an established strategic beta product line?

- Does the provider profit from securities lending in their ETFs?

- How do the provider’s expense ratios compare with their peers’?

- How transparent and consistent is the provider?

Summary

Choosing an ETF by looking at the asset class and the specific fund is a good first step. At Schwab Asset Management, we recommend evaluating the provider as well.

There are critical differences in practices and policies across providers—even among the large ETF brands. Asking these nine questions can help you determine whether and how the provider seeks to provide successful outcomes for advisors and their clients.

Ultimately, this due diligence can help increase the likelihood of a fruitful long-term relationship between you, your clients, and the ETF provider.

Explore more ETF insights

Discover ETF Know:How

Browse our full-spectrum curriculum of ETF tools and resources designed to help you boost your knowledge and gain a competitive advantage.

Explore Schwab ETFs

Help your clients get exceptional value from their investments with the product finder.