Fixed Income Outlook: Cool and Cloudy

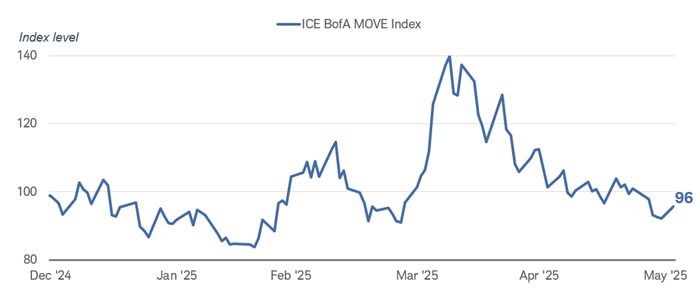

Coming into 2025, the one thing we felt confident in forecasting was ongoing volatility in the fixed income markets. We have not been disappointed with that call. The MOVE index, which measures volatility in the Treasury bond market, spiked higher in April as the market responded to rapid and still-evolving changes in trade and economic policies.

The MOVE Index spiked in April

Source: Bloomberg, daily data from 12/31/2024 to 6/3/2025.

The ICE BofA (MOVE) Index is a yield-curve-weighted index of the normalized implied volatility on 1-month Treasury options. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

More recently, yields for 30-year Treasury bonds pushed above 5%, the highest level since 2007, on concern that the proposed tax-and-spending bill currently working its way through Congress will support stronger growth, raise the budget deficit, and increase the size of total U.S. government debt. It's not just the U.S. bond market that is responding to rising government debt: The higher trend in long-term yields has been a global phenomenon. The market is signaling that adding to government budget deficits accumulated during the last 20 years, when interest rates and inflation were low, will require higher yields to attract investors.

Long-term Treasury bond yields have risen

Source: Bloomberg.

U.S. Generic 30-year Treasury Yield (USGG30YR INDEX). Weekly data from 5/30/2005 to 5/30/2025. Past performance is no guarantee of future results.

Heading into the second half of the year, the dominant trend likely will be a steeper yield curve—with the difference between long- and short-term yields expanding as investors demand more yield to hold long-term bonds during volatile times.

Later in the year, we see scope for yields to fall modestly, assuming economic growth slows and inflation pressures ebb. We still anticipate one or possibly two rate cuts by the Federal Reserve this year, starting at the earliest in September.

Economic outlook: Cool and cloudy

Economic growth has held up well so far this year, supported by a resilient labor market and solid consumer spending, but there are signs of a slowdown on the horizon. Consumer surveys show widespread pessimism amid concerns about rising prices due to tariffs and cuts in federal spending. The specter of "stagflation"—stagnant economic growth with rising inflation—is hanging over consumer sentiment.

The on-again/off-again trade war has also made businesses cautious about investing and hiring. On April 2nd, "Liberation Day," President Donald Trump announced tariffs on dozens of countries. Tariff levels and timing have fluctuated significantly since then. On May 28th, a federal court blocked most of the tariffs, saying the president had exceeded his authority—a ruling the Trump administration plans to appeal.

Tariffs are paid by companies importing goods and generally passed along to consumers. Manufacturers can be especially hit hard by tariffs as costs for imported goods rise and supply chains are disrupted. But even in the service sector, concerns are rising. The April U.S. Business Leaders Survey Future Capital Spending Current Conditions index, based on a survey of business leaders by the New York Federal Reserve Bank, showed capital spending intentions fell to the lowest level since the pandemic.

Business capital spending plans have weakened

Source: Bloomberg, monthly data from 5/30/2015 to 5/30/2025.

US Business Leaders Survey Future Capital Spending Current Conditions (NYBLCNFC Index). It is a monthly survey conducted by the Federal Reserve Bank of New York that asks companies in its district—which includes New York State, northern New Jersey, and Fairfield County, Connecticut—about recent and expected trends in key business indicators. The diffusion index reflects the difference between the percentage of respondents reporting lower spending plans versus the percentage reporting higher spending plans.

The most recent Beige Book, a survey of economic conditions prepared by the Federal Reserve released in advance of its May 6th-7th meeting, also highlighted the risk to growth from trade policy. It indicated that economic activity was unchanged to slightly lower compared to the previous period, but that "uncertainty around international trade policy was pervasive." It noted a "deterioration in demand," with two-thirds of districts reporting that "activity in the manufacturing sector was little changed or had declined."

At the time of this writing, the Trump administration continues to pursue an aggressive trade policy, despite court challenges. It appears that the average tariff rate is likely to be at least 7% and possibly up to 17.8%, according to the Yale Budget Lab. The average tariff rate was 2.5% in 2024. That difference is significant. The higher the tariff rate, the more potential drag on economic growth. At the upper end of the range, the average tariff rate would be the highest level since 1934. Moreover, the uncertainty over the tariff rate can delay business decision making, which is usually negative for growth.

Diversification and the dollar

Efforts to reduce the trade deficit may result in higher bond yields. A smaller trade deficit means less in the way of capital inflows from abroad. With less foreign capital coming into the United States, bond prices (which move inversely to yields) can be expected to decline as demand weakens.

When tariffs were announced at higher-than-expected levels on April 2nd, U.S. assets sold off sharply—both stocks and bonds. In the aftermath, Treasury yields rose despite the steep drop in stocks, leading to concerns that the bond market wasn't providing the diversification benefits during times of volatility that it once did. The U.S. dollar also reacted unexpectedly. Typically, the currency of the country imposing tariffs would rise to offset the tariff cost. However, the dollar has weakened by about 7% since the trade war began, as investors reduce expectations for U.S. economic growth due to supply chain disruptions and lower consumer demand.

If tariffs are removed or rolled back significantly, the dollar likely will rebound, Treasury yields probably will decline and the issue of whether Treasuries provide diversification will fade. That situation is still evolving. Over the long run, we believe the Treasury market will continue to be considered a safe haven during times of turmoil. However, it wouldn't be surprising to see more of these temporary dislocations in the markets due to shifting policies.

The 10-year Treasury yield rose while stocks dropped in April

Source: Bloomberg, daily data from 6/2/2024 to 6/2/2025.

US Generic Govt 10-year Treasury Yield (USGG10YR Index) and S&P 500 Index (SPX Index). Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly.

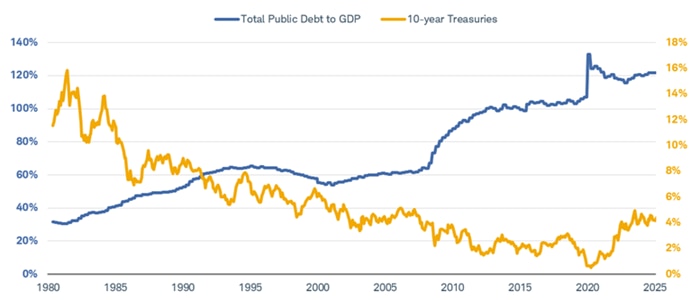

Fiscal policy is also a factor

Another policy issue hanging over the market is the budget deficit. At this juncture, it appears that Congress will pass a bill that is projected to expand the deficit by about $3 trillion to $4 trillion over the next 10 years and raise the ratio of debt to gross domestic product (GDP) to a new high. Over the long run, there hasn't been much correlation between bond yields and the level of debt and deficits, because the U.S. has the capacity to service the debt and the dollar—as the world's reserve currency—provides support to the Treasury market. Treasury yields have generally declined over the last four decades despite the rising debt-to-GDP ratio. However, the prospect of years of rising issuance of Treasuries could add to upward pressure on long-term yields.

There hasn't been much correlation between debt levels and bond yields

Source: Bloomberg, quarterly data from 4/30/1980 to 4/30/2025.

Federal Debt Total Public Debt as a Percentage of GDP (FDTGATPD Index), and U.S. Generic 10-year Treasury Yield (USGG10YR INDEX). Past performance is no guarantee of future results.

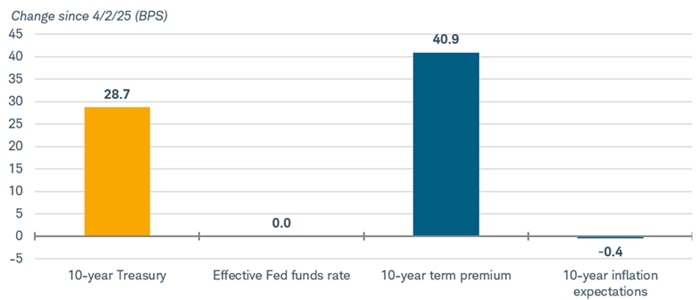

The term premium—the extra yield that investors demand to hold long-term bonds rather than a series of short-term bonds—has been rising steadily over the past year. In general, the term premium is used to explain the degree of uncertainty that markets have about the future direction of policy. A rough way to decompose the drivers of the 10-year Treasury is to look at the change in the federal funds rate, inflation expectations, and the term premium. Since "Liberation Day" most of the rise in 10-year Treasury yields has been driven by the term premium. Note that the change in the fed funds rate, inflation expectations and the term premium don't add up to the change in the 10-year Treasury yield because of different factors we assign to each of those variables.

Most of the rise in the 10-year yield has been driven by the term premium

Source: Bloomberg, as of 5/29/2025, which is the most recent data available for ACMPT10 Index. Data from 4/2/2025 to 5/29/2025.

U.S. Generic 10-year Treasury Yield (USGG10YR Index), US Federal Funds Effective Rate (FEDL01 Index), Adrian Crump & Moench 10 Year Treasury Term Premium (ACMTP10 Index), and US Breakeven 10 Year (USGGBE10 Index). For illustrative purposes only.

The term premium has risen sharply since the April 2nd tariff announcement and is now at the highest level in more than a decade.

The 10-year term premium has risen

Source: Bloomberg. Adrian Crump & Moench 10-year Treasury Term Premium (ACMTP10 Index). Daily data from 5/29/2010 to 5/29/2025.

The term premium is the compensation that investors require for bearing the risk that short-term Treasury yields do not evolve as they expected. The term premium in the chart above is obtained from a statistical model developed by New York Federal Reserve Bank economists Tobias Adrian, Richard K. Crump, and Emanuel Moench. For illustrative purposes only.

We expect the term premium to continue to keep long-term yields elevated relative to short-term yields due to policy uncertainty around inflation and increased issuance of Treasuries to fund deficits. Consequently, the yield curve is likely to continue to steepen in the second half of the year.

The yield spread between two-year and 10-year Treasuries has widened

Source: Bloomberg. Market Matrix US Sell 2 Year & Buy 10 Year Bond Yield Spread (USCY2Y10 INDEX). Data is from 6/2/2019 to 6/2/2025.

This spread is a calculated Bloomberg yield spread that replicates selling the current 2-year U.S. Treasury note and buying the current 10-year U.S. Treasury note, then factoring the differences by 100. Shading indicates past recessions. A basis point is equal to one-hundredth of one percent, or 0.01%. Past performance is no guarantee of future results.

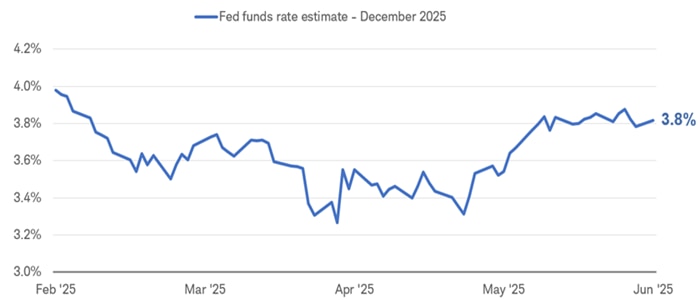

Federal Reserve Policy: Still navigating through the fog

We look for the Federal Reserve to lower its policy federal funds rate—the rate banks charge each other for overnight loans—one or two times in the second half of the year, bringing the upper bound of the target range down to the 4% area. The earliest we anticipate a rate cut is the September meeting, as the Fed has indicated it wants time to evaluate the impact of various policies on the economy and inflation.

Market expectations about the path of Fed policy have shifted since the beginning of the year. The current expectation is for two rate cuts in 2025 and one or two more cuts in 2026. Expectations about the path of Fed policy are likely to keep shifting with the economic data and policy developments, adding to volatility.

Market expectations for the end-of-year federal funds rate have risen

Source: Bloomberg, daily data from 2/6/2025 to 6/2/2025.

World Interest Rate Probability (WIRP) Implied Overnight Rate for the US - Futures Model (US0AFR OCT2025 Index). WIRP Implied Overnight Rate for the U.S. - Futures Model represents the estimated forward rate for the United States using the futures model. This ticker utilizes "virtual ticker" technology to show multiple dimensions of data via a single ticker. By default (without a virtual component added) the ticker always references data for the upcoming meeting of the country under analysis. Once a meeting passes, the ticker then rolls to the next meeting. For illustrative purposes only. Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read the Risk Disclosure Statement for Futures and Options prior to trading futures products.

There are two components to the Fed's dual mandate—price stability and full employment. The unemployment rate at close to 4% is low and job growth has been consistent with it staying low. Inflation's decline, however, has stalled in the 2.5% to 3.0% region, well above the Fed's 2% target.

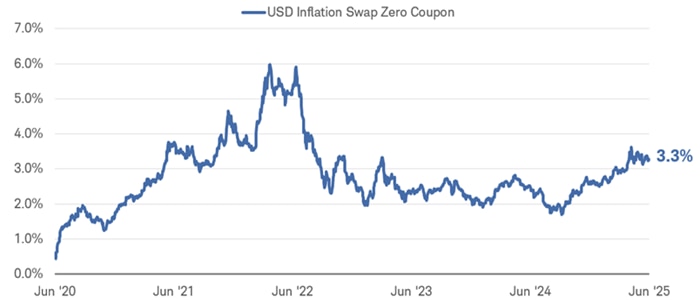

Moreover, one-year inflation expectations have been rising since last year and stand at the highest levels since the COVID-19 pandemic, when supply shortages resulted in an inflation spike. There are many ways to measure inflation expectations, using surveys or market-based measures. All of them indicate inflation expectations are moving higher.

The chart below shows the trend in one-year Consumer Price Index (CPI) swaps, which is a measure we like to use because it reflects the decisions that money managers make with their investing dollars. CPI swaps are used for inflation hedging. They represent the yield at which investors are willing to exchange a fixed rate for a floating rate linked to inflation as measured by the CPI. As the chart indicates, the swap rate has been rising and is currently above 3% for a one-year time frame. The trend is running too high for the Fed to ease policy. It wants to see inflation "well anchored" near its 2% target. It's a reason for the Fed to remain on hold.

The inflation swap rate has been rising and is above 3%

Source: Bloomberg, daily data from 6/2/2020 to 6/2/2025.

USD Inflation Swap Zero Coupon (USSWIT1 Curncy) reflects a derivative used to transfer inflation risk from one party to another through an exchange of cash flows. In a zero-coupon inflation swap, only one payment is done at maturity where one party pays a fixed rate on a notional principal amount, while the other party pays a floating rate linked to an inflation index. For illustrative purposes only.

Stability and opportunity in volatile markets

Volatility may persist in the bond market, but it can create opportunities. Even with the rise in yields year to date, the total return of the Bloomberg Treasury Index is currently up 2.1%, despite the rise in long-term yields. The positive return has generally been driven more by the coupon income—regular interest payments—than by price changes.

The Bloomberg U.S. Treasury Index total return is higher year to date

Source: Bloomberg, total returns from 12/31/2024 through 5/30/2025.

Bloomberg U.S. Treasury Index (LUATTRUU Index). Total returns assume reinvestment of interest and capital gains. Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

With the risk of higher yields in the short term and elevated volatility, we continue to favor taking a cautious stance in the fixed income markets. The push-pull effects of tariffs and fiscal policy will likely remain a key feature of the market. We see the potential for 10-year Treasury yields to go back to the 5% level in the second half of the year.

Consequently, we suggest keeping average duration in portfolios at benchmark or below levels. (We use the Bloomberg Aggregate Bond Index for benchmark. It currently has an average duration of about six years.) We think maintaining high credit quality is also important due to the risk of a slowdown in the economy.

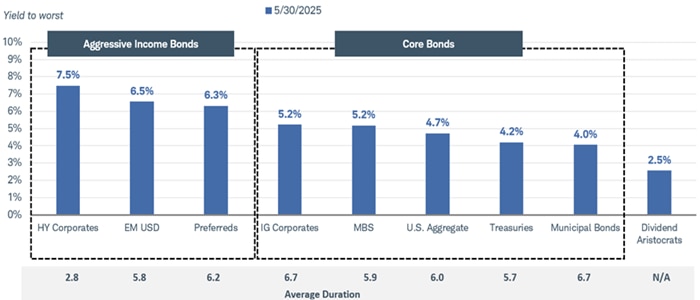

But we also see opportunities for long-term investors to potentially capture attractive yields in various segments of the fixed income markets, such as investment-grade corporate bonds, securitized bonds and municipal bonds. Yields in the 4.5% to 5.5% region should provide positive real returns over the intermediate-term horizon. Generally speaking, the income portion of bond investments contributes the majority of the total return. Since all income is positive, current coupons in the 4.5% to 5.5% region should provide offset to potential price declines.

Average yields for a variety of fixed income investments

Source: Bloomberg, as of 5/30/2025.

Indexes represented are: Bloomberg U.S. Aggregate Bond Index (U.S. Aggregate), Bloomberg U.S. Corporate Bond Index (IG Corporates), Bloomberg U.S. Corporate High-Yield Bond Index (HY Corporates), Bloomberg U.S. Municipal Bond Index (Municipal Bonds), ICE BofA Fixed Rate Preferred Securities Index (Preferreds), Bloomberg Emerging Market USD Aggregate Index (EM USD Bonds), Bloomberg U.S. MBS Index (MBS), Bloomberg U.S. Treasury Index (Treasuries), and the S&P 500 Dividend Aristocrats Index (Dividend Aristocrats). Yields shown are the average yield-to-worst except for the Dividend Aristocrats, which is the average dividend yield. Yield to worst is the lowest possible yield an investor can receive on a bond with a call option, barring default. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Overall, it looks like volatility is going to remain a key feature of the fixed income market in the second half of 2025. We continue to suggest taking a cautious stance in the markets but also favor taking advantage of times when yields rise to potentially capture attractive income over the intermediate term.