Schwab's Market Perspective: On Firmer Ground?

Listen to this article

Listen to the latest Schwab Market Perspective.

Markets have been encouraged so far this year by relatively steady U.S. nonfarm payroll data, but White House tariff policy remains a moving target. On the positive side of the ledger, tariff rates are down significantly from the April 2nd "Liberation Day" levels—but on the other hand, trade negotiations are ongoing, as is the uncertainty.

Bond markets have calmed, but it may be a temporary quiet period. The tariff deadline was extended to August 1st, keeping uncertainty simmering, and the speculation about when the Federal Reserve will lower the federal funds rate will heat up as fall approaches.

Meanwhile, governments around the globe are finding it difficult to cut deficits, leading to political friction and rising bond yields in some countries.

U.S. stocks and economy: A change is gonna come?

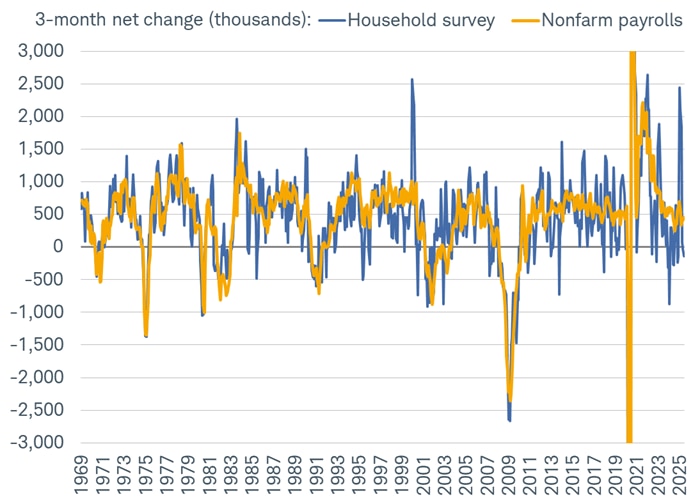

As we begin the second half of the year, the economy remains on somewhat firm ground, but not without some potential tremors under the surface. We think the strongest tell for how growth will hold up will be the state of the labor market. At the midway point of 2025, labor looked to be in a solid position based on nonfarm payroll growth. As shown in the chart below, the three-month change in payrolls has eased considerably over the past few years but has also stabilized at a level consistent with prior economic expansions. More volatile has been the household survey, from which the unemployment rate is calculated.

Payrolls tell a solid story

Source: Charles Schwab, Bureau of Labor Statistics (BLS), Bloomberg, as of 6/30/2025.

The BLS payroll survey is designed to measure employment, hours, and earnings in the nonfarm sector; a representative sample of businesses in the U.S. provides the data for it. The household survey is designed to measure the labor force status of the civilian noninstitutional population with demographic detail; a representative sample of U.S. households provides the information for the household survey.

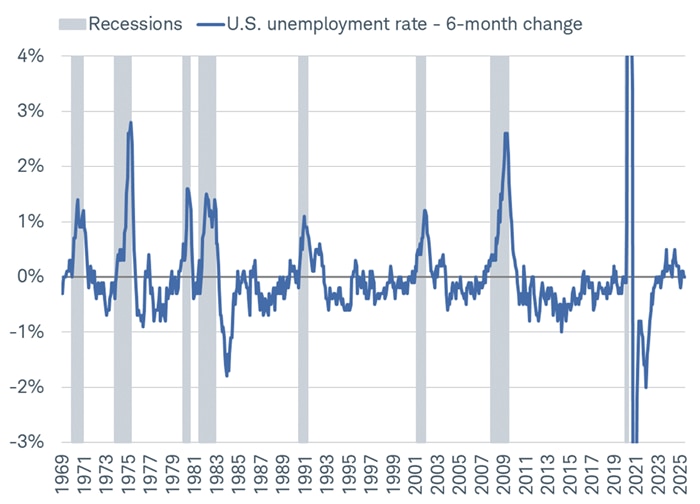

Speaking of the unemployment rate, its drop in June—to 4.1% from 4.2%—was perhaps the most notable development in the June jobs report. To be sure, the decline was for the "wrong" reason in that the contraction in the labor force was quite large. That may not necessarily continue, but a continued deterioration would be a worrisome sign for the economy. For now, though, the upside is that the upward momentum in the unemployment rate has halted.

As shown in the chart below, the six-month change in the unemployment rate gathered steam last year—at times, to levels consistent with what we've seen at the start of prior recessions. Fortunately, that momentum has stalled out, with the unemployment rate essentially unchanged over the past six months. That is rare to see in history, as unemployment is typically falling or rising as opposed to holding steady.

Unemployment rate's rise stalls out

Source: Charles Schwab, Bureau of Labor Statistics (BLS), Bloomberg, as of 6/30/2025.

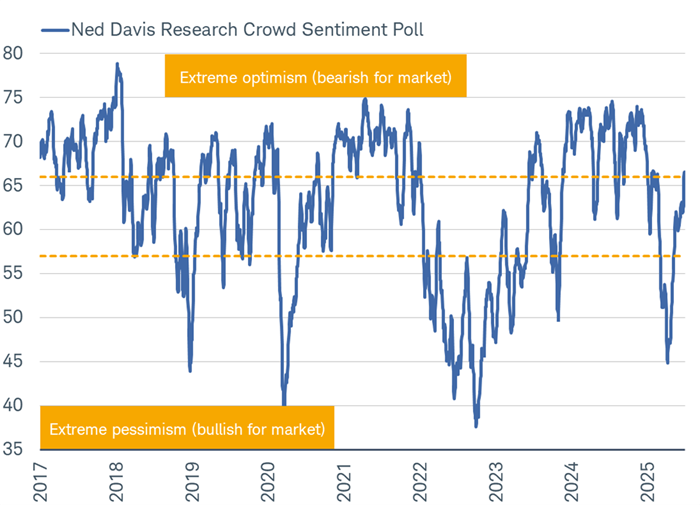

The stock market has reacted positively to the resilience of the labor market but has unquestionably been driven more by Washington policy this year. As of this writing, the Trump administration is still working through several negotiations with countries, which means the average U.S. tariff rate continues to be a moving target. Amid drawn-out negotiations, the market has reacted favorably to the fact that tariff rates have come down from "Liberation Day" levels, evidenced by the significant snapback in investor sentiment.

As shown in the chart below, Ned Davis Research's Crowd Sentiment Poll (CSP) has crept back into "extreme optimism" territory. Historically, that is the weakest zone for the market, but history also suggests that sentiment can get increasingly "frothy" from here—not least because the CSP has only recently crossed into "extreme optimism" territory.

The crowd grows louder

Source: Charles Schwab, Bloomberg, as of 7/1/2025.

Vertical axis is in index points. © Copyright 2025 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/

With sentiment, it's always worth reminding investors that extreme bouts of optimism can make stocks more vulnerable to a negative catalyst. Policies from Washington have mostly been consistent catalysts this year, but we would add the labor market as one to watch in the back half of the year—especially if the labor force continues to deteriorate.

Fixed income: Calm between the storms?

Bond markets have settled down after volatility sparked by the budget bill, the Federal Reserve meeting, and tariff uncertainty. Treasury yields currently are about unchanged from a month ago; however, the U.S. dollar continues to trend steadily lower.

We view the bond market's recent steadiness as the calm between the storms. The July 9th tariff deadline has been extended, which will keep uncertainty elevated. The Fed is on hold for now—but the guessing game about when it will lower the federal funds rate is bound to continue. Currently the market is expecting one rate cut in 2025 and a three to four more in 2026. However, inflation will need to get closer to the Fed's 2% target to justify a rate cut—something that may prove difficult with the prospect of tariffs still on the horizon and a sinking dollar.

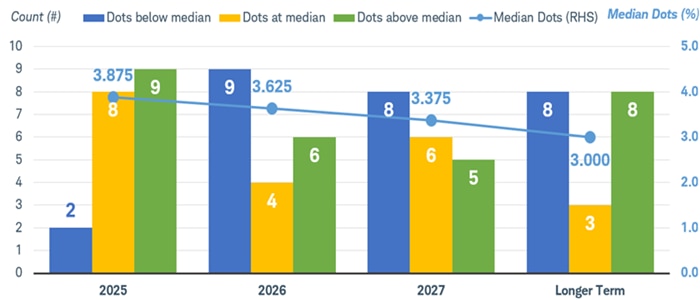

At the July Federal Open Market Committee (FOMC) meeting the median projection was for two rate cuts by year-end. However, the committee's views were clearly divided. Seven members projected that there would be no rate cuts this year and two projected just one cut. The bar for rate cuts at the Fed appears to be high.

Fed members are projecting two rate cuts this year

Source: Bloomberg, as of 6/18/2025.

Median dot represents the median forecast from the 6/18/2025 FOMC meeting. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

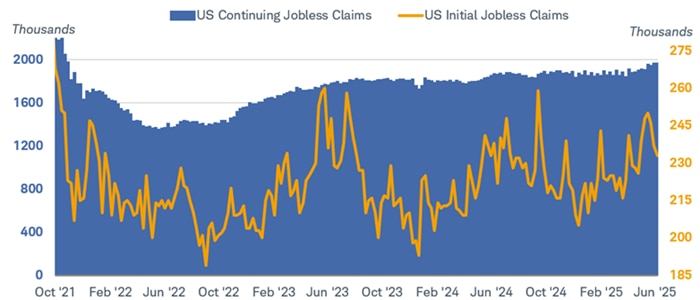

We expect the labor market will provide the catalyst for a rate cut later this year. While job growth has been resilient, it has slowed. The ripple effect of federal spending cuts for various agencies and private institutions is likely to mean a weaker job market in the fall. Layoff announcements have increased and the steady rise in continuing unemployment claims suggests that workers that have been laid off are having difficulty finding new jobs. We would expect the Fed to respond to weakness in the labor market with a rate cut by the September meeting.

Continuing jobless claims have been elevated

Source: Bloomberg. Weekly data from 10/22/2021 to 6/28/2025.

US Initial Jobless Claims SA (INJCJC Index) and US Continuing Jobless Claims (INJCSP Index).

In the meantime, we are keeping a close eye on the dollar. It has fallen by about 10% on a trade-weighted basis, which can add to inflation pressure. A weaker dollar makes the cost of imported goods rise. Since the U.S. is a large net importer, the downtrend in the dollar can have a significant effect on inflation.

The dollar has declined in recent months

Source: Bloomberg. Bloomberg Dollar Spot Index (BBDXY Index). Daily data from 7/7/2015 to 7/7/2025.

The Bloomberg US Dollar Spot Index (BBDXY Index) tracks the performance of a basket of global currencies against the U.S. dollar. Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

For investors, the good news is that real interest rates—those adjusted for inflation—are attractive. Real 10-year Treasury yields are near 2%, holding well above levels seen in the past 15 years. Investors are getting compensated for inflation risk.

The push-pull between slower growth and inflation likely will continue into the fall. We continue to suggest keeping an average portfolio duration in the five- to seven-year vicinity but may consider adding duration down the road, if the inflation outlook improves. We are keeping a close eye on the labor market for a signal of an approaching Fed rate cut and the dollar for potential inflation risk.

International stocks and economy: Fixing deficits is unpopular

Politicians typically have an easier time adding government spending than taking it away, yet years of high deficits is requiring tough decisions. Take the case of Japan. Japan's economy is being transformed by the existence of inflation after 30 years of deflation. Although deflation is harmful to economic growth through consumption delays triggered by anticipation of lower prices, inflation without high enough wage increases can also suppress consumption.

The COVID-19 pandemic resulted in global inflation and in Japan, wages started rising for the first time in decades. The hope is that with higher wages, consumers might spend more, stimulating economic activity. The problem? Wages have not risen enough to overcome inflation in Japan, and consumers seem to be losing patience—and blaming politicians.

Japan's consumer confidence remains relatively weak

Source: Charles Schwab, FactSet, Japan Economic and Social Research Institute as of 6/30/2025.

Index is a range from 0 to 100, with values above 50 indicating more households think economic conditions are improving and values below 50 indicate more households think economic conditions are worsening.

The October 2024 election saw seat losses by the Liberal Democratic Party (LDP) and Japan's ruling coalition government is facing the potential for more losses in an upper house election on July 20. The prospect of losing power may result in pressure on the LDP to cut taxes and increase spending. If Japan's deficit looks set to increase, the Japanese government bond (JGB) market could experience volatility. That volatility could spill over into bond and stock markets globally thereafter. In June, both the Bank of Japan (BOJ) and Ministry of Finance (MOF) took steps to ease liquidity pressure in longer-term JGB maturities. Any threat to financial stability may cause the BOJ to slow the pace of balance sheet reduction again and the MOF shift even more issuance to shorter duration bonds. Additionally, the BOJ and MOF may be able to calm markets by talking about future actions they could take without needing to take decisive action.

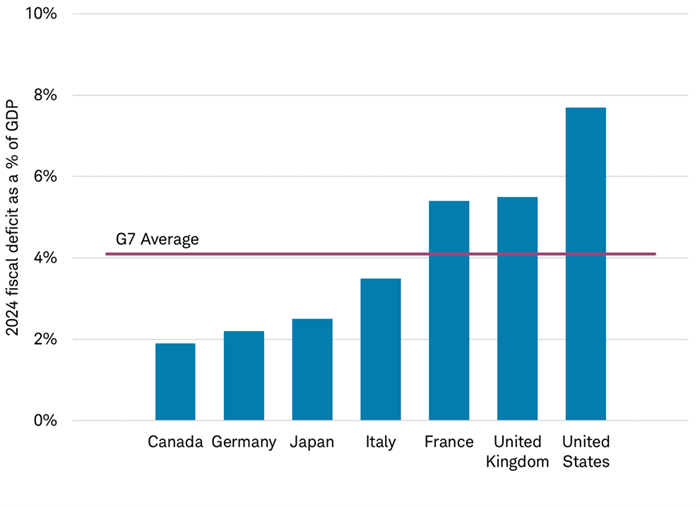

In Europe, fixing deficits is also causing friction. In the U.K., government bond yields spiked higher in early July due to questions about adherence to fiscal rules designed to keep deficits in check that arose after the government backtracked on some unpopular spending cuts; tax increases are possible in the autumn. Disagreements over actions needed to meet European Union (EU) rules that require reducing the French deficit from 5.8% in 2024 to 3% by 2029 have resulted in the eighth no-confidence vote for Prime Minister Francois Bayrou, setting up a budget fight and potential new elections in the fall. Deficit troubles in some European countries may hinder their ability to meet the increased NATO defense spending target of 5% of gross domestic product (GDP) by 2032.

Larger-than-average deficits are not uncommon

Source: Charles Schwab, International Monetary Fund April 2025 Fiscal Monitor, as of 6/30/2025.

Data reflects cyclically adjusted fiscal deficits as a % of potential GDP. A cyclically adjusted budget deficit (or surplus) represents the potential budget deficit or surplus, excluding the effects of the business cycle; it seeks to remove the automatic changes in tax revenues and government spending that occur as the economy expands or contracts. The G7, or Group of Seven, is an informal forum of the world's advanced economies: Canada, France, Germany, Italy, Japan, the U.K. and the U.S.

One country that may have an easier time is Germany. Germany's fiscal discipline over the years has resulted in a debt-to-GDP of just 64% in 2024, according to the International Monetary Fund—roughly half that of the U.S. Changes in U.S. policies toward NATO prompted Germany to pass defense and infrastructure spending bills this spring that translate to 1 trillion euros of spending over the next decade, so Germany's fiscal deficit is expected to increase. The issuance of more German government bonds to boost economic growth could attract new investors and increase demand for the euro. Although spending may not be linear, increased defense spending could be a durable, secular trend. European countries may prioritize European defense companies. So far this year, the MSCI EMU Aerospace and Defense Index in USD is up 68% through July 10, while the S&P Aerospace and Defense Select Industry Index has returned 27%.