Bond ladders vs. ETFs

Introduction

Fixed income investments (bonds) can increase diversification in a portfolio and may offer regular income that may be exempt from state or federal taxes (as with municipal bonds and U.S. Treasuries). Two popular ways to access bonds are through bond ladders and fixed income exchange-traded funds (ETFs).

Understanding bond ladders

A bond ladder is a strategy of buying a series of bonds with similar face values and staggered maturities. This means the bonds will pay similar amounts to the bondholder as they mature on different dates. Compared to a single bond, a ladder can increase diversification and potentially reduce credit risk, interest rate risk, and reinvestment risk. Also, the investor receives a predictable stream of cash flow.

In a rising interest rate environment, investors can reinvest the principal—ideally at higher yield—as each bond matures. In a falling interest rate environment, investors will still have some bonds with longer maturities in their ladder to maintain higher yields. Eventually, however, investors may need to consider investing at a lower interest rate than they once had.

Another consideration for a bond ladder is the cost. Often, bonds are sold in minimum denominations of $1,000, which means attaining diversification can add up to a substantial amount.

Key terms

While there are benefits to adding fixed income to a portfolio, there are risks, which include:

- Credit risk: This is the risk of default, credit downgrade, or change in credit spread.

- Interest rate risk: The risk that changes in interest rates may reduce the value of bonds an investor holds. Interest rate risk increases the longer the time period remaining until a bond’s maturity.

- Reinvestment risk: The risk that future cash flows, such as interest payments on bonds, cannot be reinvested at a rate comparable to the current one.

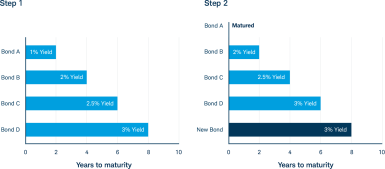

Example of a bond ladder

In step 1 of this example, an investor buys several bonds with staggered maturities. Here the ladder includes four bonds with a combined average annual yield of 2.125%. In step 2 of this example, bond A matures and the investor reinvests the proceeds in a new bond, extending the ladder. The investor can continue to do this as bonds mature in the future.

This hypothetical example is for illustrative purposes only. It cannot predict or project the return of any specific investments. While predictable, bond income is not guaranteed and is subject to call risk as well as possible default on principal and interest (which increases with lower-rated securities).

Understanding fixed income ETFs

A fixed income ETF is a pooled portfolio of bonds that generally tracks an index of bonds and seeks to replicate or outperform its returns, depending on whether it’s an active or passive ETF. The ETF trades on an exchange like a stock, offering several benefits to investors.

Price transparency and liquidity. Because fixed income ETFs trade on an exchange, they offer intraday trading and are continuously priced throughout the trading day, regardless of whether the underlying assets are trading. Price transparency is especially helpful since certain corporate or municipal bonds may go days or weeks without trading because investors tend to buy and hold them for very long periods of time, including to maturity.

Diversification. Investors can gain access to hundreds or thousands of bonds in a fixed income ETF, thus diversifying across issuers and industry sectors, and potentially reducing credit risk.

No maturity. Most individual bonds have a stated maturity date when investors can expect to receive their principal back. In contrast, most fixed income ETFs maintain a weighted average of all bond maturities in the fund, allowing these ETFs to exist in perpetuity without maturing.

Choice of duration. Investors can target the yield curve range they’d like to invest in: short-term, intermediate-term, or long-term.

Monthly income. Because fixed income ETFs hold many different bonds at once, they may pay interest monthly (although the amount may vary). In contrast, individual bonds typically pay coupons twice yearly.

Comparing instruments

| Bond ladder | Fixed Income ETF | |

|---|---|---|

| Overview | Can provide steady income while helping to reduce exposure to changing interest rates Typically must be purchased directly from a seller because bonds typically trade over-the-counter. Usually, requires a brokerage account to buy and sell bonds. | Can help investors diversify in certain market segments with one investment Typically requires a brokerage account to buy and sell shares on an exchange |

| Income frequency | May vary, given that most bonds typically pay income twice a year | Usually monthly |

| Liquidity | May be lower as bonds typically trade over-the-counter | May be higher because ETFs trade like a stock |

| Ease of use | May be more time intensive to construct and maintain the ladder | May be less time intensive because buying an ETF is like buying a stock on an exchange |

| Costs | Possible transaction fees Typically wider spreads when trading individual bonds | Operating expenses and possible trade commission Typically narrower spreads when trading ETFs |

| Principal preservation | Principal returned when a bond matures (given the issuer does not default) | Most ETFs do not terminate, therefore principal investment will fluctuate |

This is not an exhaustive list and is provided for illustrative purposes only.

Summary

Bond ladders and fixed income ETFs each have advantages. A bond ladder may lower interest rate risk and reinvestment risk while giving the investor predictable cash flow. A fixed income ETF may be easier and less expensive than constructing a bond ladder, with the potential for greater diversification, price transparency, liquidity, and payment frequency. The decision over which vehicle to use requires thoughtful deliberation and a careful assessment of the investor’s objectives, associated risks, and desired time horizons.

Explore more ETF insights

Discover ETF Know:How

Browse our full-spectrum curriculum of ETF tools and resources designed to help you boost your knowledge and gain a competitive advantage.

Explore Schwab ETFs

Help your clients get exceptional value from their investments with the product finder.