Confirmation bias

- Read transcript

Confirmation bias—2-minute video

Is the confirmation bias affecting your clients? Help them find out by sharing this short, client-approved video, which provides actionable insights and guidance on how the confirmation bias can potentially influence our investment decisions. Then consider exploring the behavioral finance program for advisors linked near the bottom of the page for follow-up tools.

Confirmation bias in perspective.

Key Takeaways:

- Confirmation bias is the tendency to seek information that supports a person’s beliefs.

- This bias may lead investors to focus only on information that reinforces their opinions about an investment.

- Headlines about inflation or unemployment, for example, may convince an investor that their views on monetary policy and Federal Reserve decisions on interest rates are correct.

- Selectively choosing which information to use can lead to a lack of diversification and investments that are too risky.

- Good communication between advisors and their clients can help combat confirmation bias.

- Shifting a client’s focus away from short-term market moves and toward their long-term goals may help avoid the fallout from the confirmation bias.

What is confirmation bias?

Confirmation bias is a tendency to seek information that supports what we already believe and ignore information that contradicts these beliefs.

Confirmation bias operates in many areas of our lives. It's visible in news junkies who consume only media that supports their world view and in pessimists who focus on the negatives while ignoring the positives. Consider the first six months of market performance in 2023. Despite widespread predictions of a recession and “hard landing” due to the Fed’s rapid hikes in interest rates, the S&P 500® index was up nearly 20% year to date on July 31.

In the investing world, confirmation bias may lead people to cling to preconceived notions about their investments, while discounting information that contradicts these ideas. For example, a client whose holdings are concentrated in a specific sector or group of stocks may only absorb good news and ignore bad news regarding these investments.

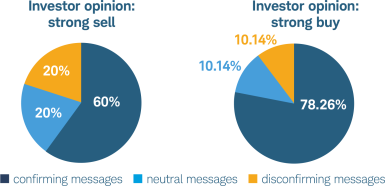

A study of online stock trading boards by the University of Texas quantified this tendency when it measured how investors responded to messages that either supported or contracted their beliefs about a certain stock. The study of more than 600 participants found that about 85% were disposed to accepting confirming opinions; about 70% who held a strong “buy” opinion clicked confirming messages; and about 60% who held a strong “sell” opinion clicked confirming messages. The vast majority said that messages that supported their preexisting beliefs had the widest support, were backed by news about the stock, and made the most convincing arguments.1

At a glance: Confirmation bias

Confirmation bias is a cognitive bias. It describes people’s tendency to seek out information that supports their beliefs.

Confirmation bias at work

The big problem: One-sided information may mean investors make decisions without a complete understanding of the situation, limiting their options and opportunities.

One well-known study of online stock trading message boards found that people overwhelmingly said the most convincing messages were ones that confirmed their pre-existing beliefs about whether to buy or sell a stock.*

How advisors can help: Implement systematic processes around activities such as trading and rebalancing to curb clients' confirmation biases.

* Park, JaeHong and Konana, Prabhudev and Gu, Bin and Kumar, Alok and Raghunathan, Rajagopal, “Confirmation Bias, Overconfidence, and Investment Performance: Evidence from Stock Message Boards,” July 12, 2010. McCombs Research Paper Series No. IROM-07-10, URL: https://ssrn.com/abstract=1639470

Why does it matter?

Confirmation bias may lead to clients overinvesting in a particular stock or sector. For example, a client who is committed to owning shares of a particular company may ignore unfavorable news about that company.

Focusing too narrowly on a particular type of investment makes clients vulnerable to company- or sector-specific downturns, which in turn can leave their portfolios misaligned with their long-term goals and risk profiles.

Confirmation bias can also keep clients from realistically viewing market conditions. For instance, they may focus on some expert opinions while ignoring others. This can potentially lead investors to make decisions based on incomplete information.

What can you do about it?

Combatting confirmation bias requires open and effective communication. Start by querying clients about their long-held investment opinions, so that you can understand their perspective thoroughly. Then, gather an array of viewpoints and present clients with information that provides alternative perspectives or adds nuances to their long-held investment beliefs.

Set up systems to help override clients’ cognitive impulses around investing. This may include creating objective trading rules around when clients can buy, sell, and rebalance their holdings. Such strategies can help them avoid making sudden investment decisions driven by their confirmation bias.

Long-term strategic asset allocation is a powerful tool in helping clients avoid confirmation bias. Establishing a predetermined mix of assets and asset classes with tolerance ranges can help clients stay disciplined.

It can also help to remind clients to take a long-term view of their investments using a goals-based portfolio-construction process. Shifting their focus toward their goals and away from their individual investments can help them more easily embrace proper diversification.

Overcoming a client’s confirmation bias doesn't just lead to potentially better outcomes for your clients. Since it requires that you and your clients work closely together, it's an opportunity to strengthen relationships and improve retention over the long term.

Omar Aguilar, Ph.D.

President, Chief Executive Officer, and Chief Investment Officer

About the author

Omar Aguilar, Ph.D.

What to read next

Decoding client biases

By focusing on education and awareness around behavioral biases, advisors can deliver even more value to clients-and potentially build even stronger practices. Here's how to start.

Biagnostics Toolkit

Biagnostics provides a suite of educational and coaching tools advisors can use to assess client behaviors, build strong relationships and help bridge the gap between clients’ financial wants and needs