Overconfidence bias

- Read transcript

Overconfidence bias—2-minute video

Is the overconfidence bias affecting your clients? Help them find out by sharing this short, client-approved video, which provides actionable insights and guidance on how the overconfidence bias can potentially influence our investment decisions. Then consider exploring the behavioral finance program for advisors linked near the bottom of the page for follow-up tools.

The overconfidence bias in perspective.

Key Takeaways:

- Overconfidence bias is the tendency for a person to overestimate their abilities.

- It may lead a person to think they’re a better-than-average driver or an expert investor.

- A wealth of easily accessible online information, anecdotal evidence, or simple luck in random investments may encourage clients to place excessive faith in their own expertise.

- Overconfidence bias may lead clients to make risky investments.

- Advisors might be able to counter overconfidence bias by encouraging clients to make room for other perspectives.

- A “premortem” strategy may also help clients take a more measured approach to making financial decisions.

What is overconfidence bias?

Most people tend to overestimate their skills, whether it's changing an electrical outlet or managing their own finances. Consider that some 73% of Americans believe themselves to be better-than average drivers, according to a survey by the American Automobile Association (AAA).1 Behavioral finance has a name for this ego-driven tendency: overconfidence bias.

In investing, overconfidence bias often leads people to overestimate their understanding of financial markets or specific investments and disregard data and expert advice. This often results in ill-advised attempts to time the market or build concentrations in risky investments they consider a sure thing.

Consider that 64% of investors rate their investment knowledge highly, according to a FINRA study. The research found that younger investors tend to be more confident than older investors. Yet investors with more confidence answered fewer questions correctly on an investment knowledge quiz.2

One possible source of overconfidence: the wealth of accessible online information. Studies have found that access to voluminous information can create the illusion of understanding.3 But without sufficient knowledge and context, investors may be ill-equipped to make the most of the information available to them.

At a glance: Overconfidence bias

Overconfidence bias is cognitive. It describes people’s tendency to overestimate their abilities.

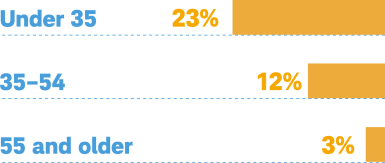

Overconfidence in action: Percentage of investors who report buying investments on margin by age:

Yet 76% of investors who used margin purchases were unable to correctly answer a factual question about the process, indicating these investors know less about their investment activities than they believe they do.*

The big problem: Thinking you’re better than average may fuel risky decisions.

How advisors can help: Introducing perspectives and possibilities the investor hasn’t considered.

* Financial Industry Regulatory Authority (FINRA), “Investors in the United States: The Changing Landscape,” FINRA Foundation National Financial Capability Study, December 2022. URL: https://www.finrafoundation.org/sites/

finrafoundation/files/NFCS-Investor-Report-Changing-Landscape.pdf** Heck, P. R., Simons, D. J., & Chabris, C. F., “65% of Americans believe they are above average intelligence: Results of two nationally representative surveys,” July 2018. URL: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6029792/

*** Edmonds, Ellen, “More Americans Willing to Ride in Fully Self-Driving Cars,” American Automobile Association (AAA), January 24, 2018, URL: https://newsroom.aaa.com/2018/01/americans-willing-ride-fully-self-driving-cars/

Why does it matter?

Overconfidence bias tricks the brain into believing it's possible to consistently beat the market by making risky bets.

But the evidence shows that even financial experts with powerful tools at their disposal can have difficulty outpacing the market. Case in point: a 2023 Morningstar report found that only a quarter of all active funds beat their passively managed peers over the previous 10-year period.4

It should be no surprise that for the average investor, overconfidence can potentially be a pathway to poor portfolio performance. Beyond that, clients’ overconfidence may also lead them to overestimate their tolerance for risk, resulting in investment strategies that don't truly align with their needs. Add to these dangers the high costs of buying and selling assets, and the potential damage of overconfidence on clients’ pocketbooks—and psyches—cannot be underestimated.

What can you do about it?

Overconfidence bias can be countered in a number of ways. One starting point is to encourage clients to make room for the perspective of other people, from family members and friends to your financial team. While we often overestimate our own abilities, we tend to be more objective when considering the decisions of others.

Another strategy is to walk clients through past investment decisions and discuss how they worked out. Demonstrate, if applicable, how overconfidence led to poor outcomes over time, and compare these outcomes with the results the client might have achieved with a more realistic approach.

Finally, consider asking clients to perform a “premortem.” This process, popularized by Nobel Prize–winning economist and psychologist Daniel Kahneman, involves imagining potential outcomes from a future perspective—perhaps 5, 10, or 20 years down the line. Start by imagining that the investment strategy you're considering has succeeded and, from this imagined point in the future, think through all the reasons it has done well. Then imagine that the same strategy has underperformed and think through all the reasons for its failure. This exercise may help people see potential risks and missteps that they might have overlooked in their excessive optimism.

Taking these steps has the potential to help protect clients from making poor investment decisions. And that, in turn, can build a deeper well of trust and strengthen your advisor-client relationship.

Omar Aguilar, Ph.D.

President, Chief Executive Officer, and Chief Investment Officer

About the author

Omar Aguilar, Ph.D.

What to read next

Decoding client biases

By focusing on education and awareness around behavioral biases, advisors can deliver even more value to clients-and potentially build even stronger practices. Here's how to start.

Biagnostics Toolkit

Biagnostics provides a suite of educational and coaching tools advisors can use to assess client behaviors, build strong relationships and help bridge the gap between clients’ financial wants and needs