Market Outlook

Market Outlook content

Market Outlook

The earnings bar is fairly low for the second quarter, setting companies up for a potential easy jump—but there will likely be more focus on forward guidance.

Bond Insights

Tax policy may continue to be a factor in the second half of the year, although Congress looks likely to maintain current tax brackets and the muni tax exemption.

Bond Insights

We continue to suggest an "up in quality" fixed income bias for the short run, but investors can still consider some of the riskier parts of the fixed income market in moderation.

Market Outlook

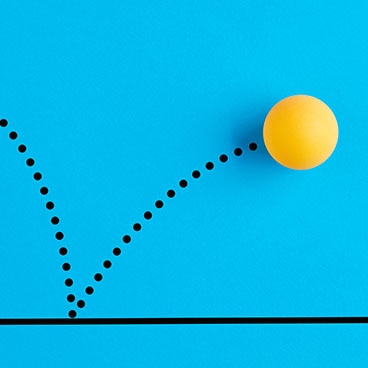

2025 has been a bouncy year so far with market ups and downs and uncertainty regarding possible tax changes and economic impacts of tariffs. Are you ready for what may come next?

Market Outlook

Investors may revisit international exposure in their portfolios amidst reduced market reactions to tariff announcements, uncertain U.S. policy and lagging U.S. stock performance.

Market Outlook

Bouts of volatility may continue in the second half of 2025 as bond market investors navigate evolving tariff policy, U.S. government debt, and economic uncertainty.

Market Outlook

Continuing last year's trend, our 2025 outlook shows fixed income benefiting from high rates, while equities face a narrowing edge over risk-free investments.

Market Outlook

The U.S. economy and stock market are entering 2025 from a position of strength, but risks of volatility—especially pertaining to policy—are much higher compared to last year.

Market Outlook

There's good news and bad news in the municipal bond market today. The bad news is that it has been the worst start to a year in more than 40 years. The good news is that the sharp selloff has created potential opportunities that largely haven't existed for 15 years.

During the second half of the year, we believe the muni market may present opportunities. We suggest that muni investors consider taking advantage of the recent selloff by moving up in both credit quality and coupon structure, and moderately extending duration if they have been investing in very short-term munis.